Are you a business owner looking to rent commercial space in Illinois or just looking for a commercial lease lawyer? Choosing the right commercial property is a crucial decision, and it’s essential to address key questions like rent amount, lease duration, utilities, and improvements. To navigate the complexities of commercial leasing agreements and protect your interests, you need the guidance of an experienced commercial real estate attorney. At Abdilla and Associates, we provide more than comprehensive legal services, we provide education to clients across DuPage County, Cook County, Lake County, and Kane County.

Table of Contents

What Kind of Commercial Lease is Right for Me?

Fixed-Rate Leases

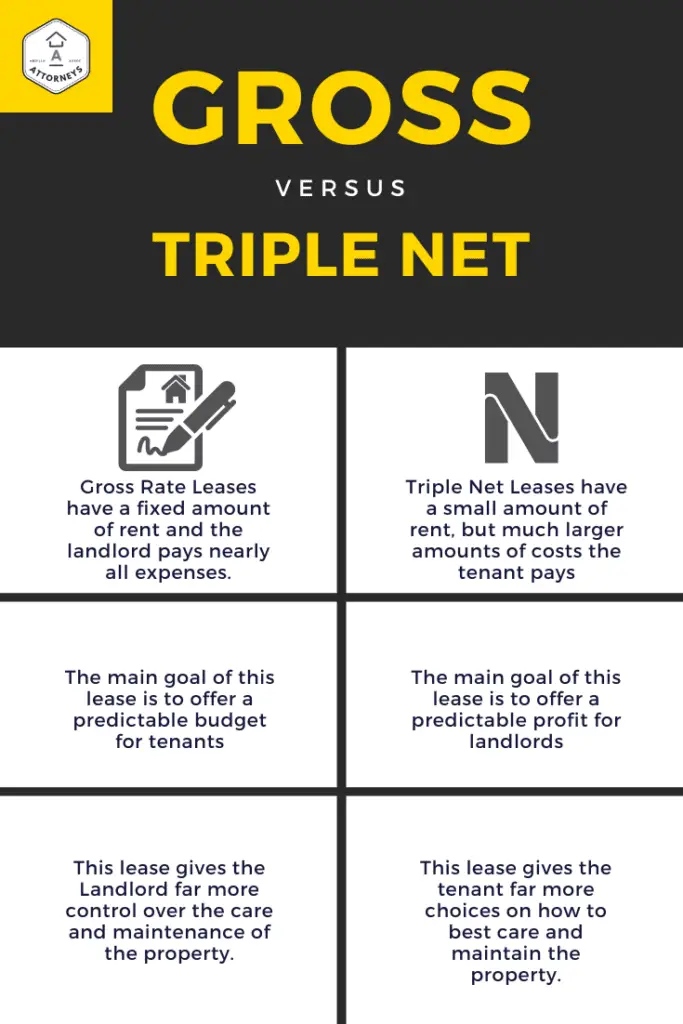

A fixed-rate commercial lease, also known as a gross lease, is a lease arrangement where the tenant pays a fixed monthly rent amount for the leased space. In this lease structure, the landlord is responsible for covering most of the property expenses, including property taxes, insurance, and maintenance costs. This lease type offers stability and predictability for tenants, as they know exactly how much they’ll pay each month without worrying about additional costs.

Triple-Net Leases

A triple net lease, commonly abbreviated as an NNN lease, is a lease structure where the tenant is responsible for paying not only the base rent but also the property’s real estate taxes, building insurance, and maintenance costs. These three additional costs are often referred to as the “three nets.” In this lease type, the tenant assumes more responsibility for the property, which may lead to a lower base rent compared to a fixed-rate lease. Triple net leases offer landlords more stability and predictability in terms of property expenses, while tenants have more control over the property’s upkeep and maintenance.

Key Differences Between Fixed Rate and Triple Net Leases by a Commercial Lease Lawyer

- Who pays for what: In a fixed-rate lease, the landlord takes care of most property expenses, while in a triple-net lease, the tenant pays for these costs.

- Rent Amount: Fixed-rate leases usually have a higher rent because the landlord covers property expenses. Triple net leases have lower rent since the tenant pays for extra costs.

- Stability: Fixed-rate leases make it easy to plan a budget, as the tenant pays the same amount every month. With triple net leases, the landlord knows how much they’ll spend on property expenses and it is easier for them to budget.

- Control: In a triple net lease, the tenant has more control over the property’s care, while the landlord handles this in a fixed-rate lease.

A commercial lease lawyer can help you understand the differences between fixed-rate and triple-net leases. They will guide you to choose the best lease for your business and make sure everything is clear and easy to understand.

Call Us About Your Commercial Lease Needs

We Can’t Wait to Help Your Business Prosper

Short-Term vs Long-Term Retail Leases: Advice from a Commercial Lease Lawyer

Understanding the difference between short-term and long-term retail leases can be tricky. Let me explain this with my knowledge as a commercial lease lawyer.

What is a Short-Term Retail Lease?

A short-term retail lease is a lease that lasts for a short time, usually less than a year. Businesses often choose short-term leases when they want to test a new location, open a pop-up store, or have a seasonal business.

What is a Long-Term Retail Lease?

A long-term retail lease lasts for a longer period, usually more than a year, and can even last for many years. Businesses that plan to stay in one location for a long time choose long-term leases, as they provide stability and more time to grow their business.

Why Choose One Over the Other?

- Duration: Short-term leases are suitable for businesses that need flexibility and don’t want to commit to a location for a long time. Long-term leases are ideal for businesses that need stability and want to invest in their location.

- Costs: Short-term leases can be more expensive per month because the landlord might charge higher rent for the flexibility. Long-term leases may have lower monthly rent because the landlord knows the tenant will be there for a longer time.

- Negotiation: Long-term leases often have more room for negotiation on terms and conditions because the landlord wants to keep a reliable tenant. Short-term leases may have less room for negotiation due to their temporary nature.

A commercial lease lawyer can help you decide whether a short-term or long-term retail lease is right for your business. They’ll explain the differences in a way that’s easy to understand and guide you through the entire process.

Understanding Percentage Rent Leases and Lease Options: Advice from a Commercial Lease Lawyer

Choosing the right type of lease for your business can be confusing. A commercial lease lawyer can help you understand different lease options and their effects on your business. These are less traditional varieties of lease agreements, but we have many clients who prefer them. Particularly with lease options, this office does quite a boutique business.

What is a Percentage Rent Lease?

A percentage rent lease is a type of commercial lease where the tenant pays a base rent and a percentage of their sales as rent. This means that if the business does well, the landlord benefits too. This type of lease can be a good option for businesses with fluctuating sales, such as retail stores, as it allows for more flexibility in rent payments. We usually see these in the beauty industry, for example.

What are Lease Options and Extensions?

Lease options and extensions are ways for tenants and landlords to plan for the future. A lease option is an agreement that gives the tenant the right, but not the obligation, to extend their lease for a specific period after the initial lease term ends. Some lease options even allow the tenant to purchase the commercial space. A lease extension is a formal agreement to continue the lease for a longer period.

Why Choose Percentage Rent Leases or Lease Options?

- Flexibility: Percentage rent leases can help businesses with varying sales manage their rent payments, while lease options offer flexibility in planning for the future.

- Shared Success: With percentage rent leases, both the landlord and tenant can benefit from the success of the business, as the landlord receives a share of the profits.

- Security: Lease options and extensions provide security for both parties, as they allow for long-term planning and stability in the business location.

A commercial lease lawyer can help you navigate the world of percentage rent leases, lease options, and extensions, making the process easier to understand. We can guide you through the entire leasing process, ensuring that your business gets the best lease terms possible.

Navigating Common Commercial Lease Provisions with a Commercial Lease Lawyer

A commercial lease lawyer can help make the process of leasing a retail space easier for you. Here, we’ll cover shopping center provisions, common area maintenance provisions, landlord-tenant buildout agreements, and exclusive use provisions and restrictions. Let’s explore why landlords are keen on using those types of provisions and restrictions. Below, you can find some of our plain-English versions of these clauses.

Shopping Center Provisions

Shopping center provisions are rules and regulations that apply to businesses located in a shopping center. These provisions help maintain the shopping center’s overall brand image and create a pleasant environment for customers. By setting rules and regulations for tenants, landlords can manage the shopping center effectively and maximize the property’s value.

Sample Clause: “Tenant shall comply with all rules and regulations established by Landlord for the shopping center, including but not limited to, signage, hours of operation, and parking.”

Commercial Lease Lawyer Drafted Common Area Maintenance Provisions

Common area maintenance (CAM) provisions are clauses in a commercial lease that detail how shared spaces, like walkways and restrooms, will be maintained and how the costs will be shared between the landlord and tenants. Landlords want to keep the property clean, safe, and well-maintained to attract and retain tenants. By including these provisions, landlords can share the financial burden of maintaining common areas, ensuring that all tenants contribute to the upkeep of the property.

Sample Clause: “Tenant shall pay their proportionate share of common area maintenance expenses, including but not limited to, landscaping, lighting, cleaning, and repairs, as determined by the Landlord.”

Landlord-Tenant Buildout Agreements

A landlord-tenant buildout agreement is part of a commercial lease that outlines the construction or improvements to be made to the leased space by the landlord and tenant, as well as the responsibilities and costs associated with the project. These agreements help avoid misunderstandings between the landlord and tenant and ensure that the buildout process proceeds smoothly. Landlords use these agreements to maintain control over the property’s appearance, quality, and compliance with regulations while allowing tenants to customize their spaces.

Sample Clause: “Landlord shall provide Tenant with an allowance of $[Amount] for the buildout of the leased premises. Tenant shall be responsible for obtaining all necessary permits and completing the buildout in accordance with the approved plans and specifications within [Time Period] from the commencement of the lease term.”

Exclusive Use Provisions and Restrictions

Exclusive use provisions and restrictions are clauses in a commercial lease that protect a tenant’s right to be the only business of a certain type in the shopping center or commercial property. These types of clauses benefit both landlords and tenants by preventing direct competition among businesses in the same shopping center or commercial property. These provisions help attract tenants by offering them a competitive advantage, while landlords benefit from having a diverse mix of businesses, which can increase customer traffic and the overall success of the property.

Sample Clause: “Landlord agrees that Tenant shall have the exclusive right to operate a [Type of Business] within the shopping center. Landlord shall not lease any other premises within the shopping center to a business that primarily engages in the sale of [Type of Products or Services].”

Reasons to Hire Our Law Firm for Your Commercial Lease Needs

Our law firm performs great work with commercial lease matters and offers a range of services to protect the interests of both landlords and tenants. Here’s why you should choose our law firm for your commercial lease needs.

Call Us About Your Commercial Lease Needs

Be One of Our Dozen Five Star Google Reviews

Protecting Landlords’ Rights and Interests

A commercial landlord should hire our law firm to ensure the rights and responsibilities of both the landlord and tenant are clearly defined and protected in case of a default. Our experienced commercial lease lawyers understand the intricacies of commercial leases and can draft or review lease agreements that cater to the landlord’s specific requirements. We help landlords avoid potential disputes by addressing critical aspects such as rent, security deposit, maintenance, and remedies in case of tenant default.

Skilled Commercial Lease Lawyers for Tenants Seeking Favorable Lease Terms

Tenants looking to negotiate the best lease terms for rent and buildout should hire our law firm because we have a strong track record of securing favorable lease terms for our clients. Our skilled negotiators understand the market and can effectively represent your interests to get the best possible deal on rent and buildout conditions. We ensure that the lease agreement offers you enough flexibility and protection to run your business successfully.

Experience in Resolving Buildout Disputes

If you have questions or concerns about the cost, delay, or quality of construction of a buildout, our law firm can help. We have extensive experience in handling disputes related to buildouts, which means we can provide you with the right guidance and representation to resolve these issues. Our commercial lease lawyers will review the buildout agreements, identify potential problems, and recommend solutions to protect your interests and minimize any potential losses.

In conclusion, our law firm’s knowledge of commercial lease matters makes us the ideal choice for both landlords and tenants seeking professional legal assistance. We are committed to providing personalized, high-quality legal services that protect your interests and help you achieve your goals.

Call Us About Your Commercial Lease Needs