President Joe Biden has proposed an annual tax credit that would give lower-income Americans $9,600 over the next two years to help with the financing of their first or second home. Sounds great, right? This tax platform will be an unmitigated, $806,400,000,000.00 disaster that our grandchildren’s children will owe eighty years from now. I arrive at that number by taking the number of first or second mortgages in America (about 86,000,000) and multiplying it by $9,600 over two years. This article is going to adopt a heavily contrarian view of tax policy and fiscal conservativism. My viewpoint is that no American should be asking the government for a $10,000 handout, no American should be willing to submit to taxation to pay $10,000 of someone else’s ordinary mortgage payments, and that this is a thinly veiled bribe to the democratic populist movement and financiers. We unequivocally condemn the mere insistence that this could be a solution to the housing crisis.

Table of Contents

The Record – What Biden Said about Mortgage Tax Credits in the 2024 State of the Union

Addressing the affordability crisis in the housing market in his State of the Union address on Thursday, Biden said: “I know the cost of housing is so important to you. Inflation keeps coming down, and mortgage rates will come down as well.

“But I’m not waiting. I want to provide an annual tax credit that will give Americans $400 a month for the next two years as mortgage rates come down, to put towards their mortgage when they buy their first home or trade up for a little more space.”

The Current State of the Mortgage Interest Deduction (MID)

The history of the mortgage interest deduction (MID) in the U.S. tax code dates back to the inception of the modern federal income tax in 1913, following a constitutional amendment. Initially, all forms of interest were deductible, not specifically to encourage homeownership, but more so as a general allowance for business expenses, considering the economic landscape dominated by small proprietors. The distinction between personal and business interests wasn’t clear, given the nature of the economy at the time. It wasn’t until the 1920s, with the rise of home mortgages surpassing farm mortgages, and further government intervention in the 1930s, such as the establishment of the Federal Housing Administration and Fannie Mae, that the groundwork for today’s mortgage industry was laid. However, the intention behind the deduction initially was not focused on homeownership as we understand it today, since the majority of homeowners at the time did not hold mortgages and thus had no interest to deduct. The MID has evolved but has been a constant feature of the tax code since its early days, with significant implications for tax policy and housing finance.

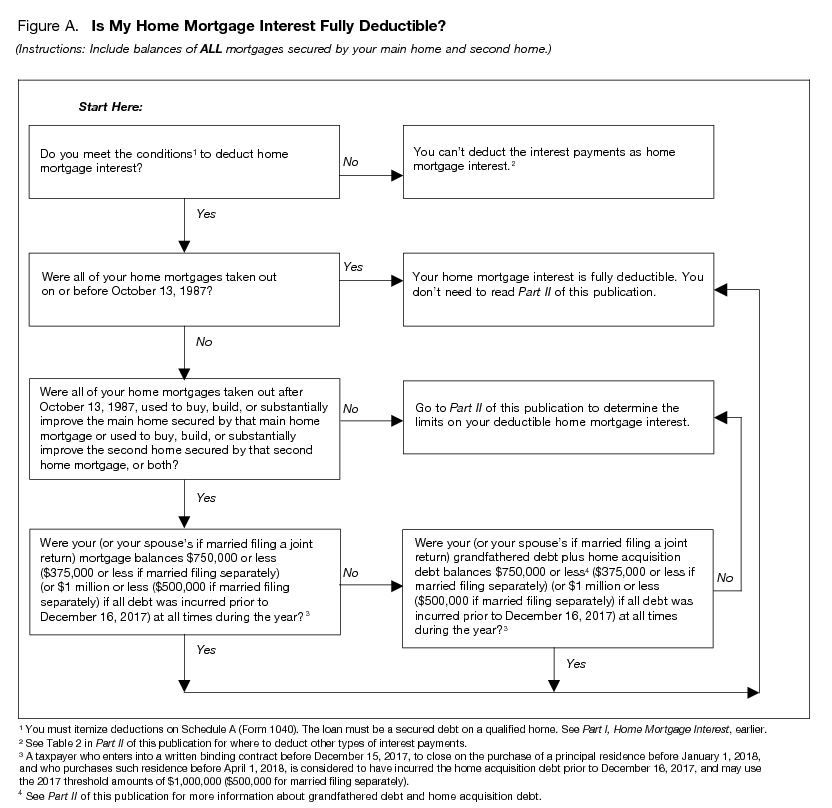

The 2017 Tax Cuts and Jobs Act and the Changes to the MID

Regarding constitutional challenges to the MID, there doesn’t appear to be significant litigation or constitutional challenges directly aimed at the mortgage interest deduction itself. Instead, discussions around the MID often revolve around its economic implications, effectiveness, and fairness, rather than its constitutionality. The MID has been subject to various changes and reforms over the years, notably with the Tax Cuts and Jobs Act (TCJA) of 2017, which altered the extent of its applicability by changing the limit of deductible mortgage debt and affecting the deduction of interest on home equity loans depending on their use. Currently, you can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($500,000 if married filing separately)) apply if you are deducting mortgage interest from indebtedness incurred before December 16, 2017. The IRS puts out a very helpful flow chart on this whole subject.

The MID is one of the most significant federal tax expenditures, and it costs approximately $30 billion annually in foregone revenue. This figure is anticipated to increase substantially after the expiration of certain TCJA provisions in 2025. The TCJA changes, including the increase in the standard deduction, have already altered the landscape, reducing the number of taxpayers who itemize deductions, including those claiming the MID. With mortgage interest rates rising sharply, the cost of the MID to the government is expected to grow, adding complexity to discussions on fiscal policy and national debt management

Why Is Housing So Unaffordable?

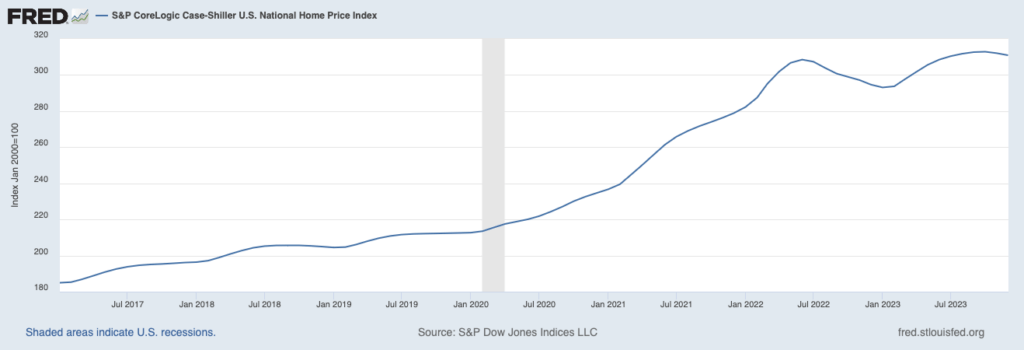

Well, it’s not because the government passed the Tax Cuts and Jobs Act. The simplest answer is the best, because the government rampantly printed money with reckless abandon during the pandemic.

Home affordability became more of a concern in the first fiscal quarter of Biden’s presidency than it did from the day Trump’s administration passed the TCJA into law to the last day of that administration. The answer is not mortgage interest and taxes.

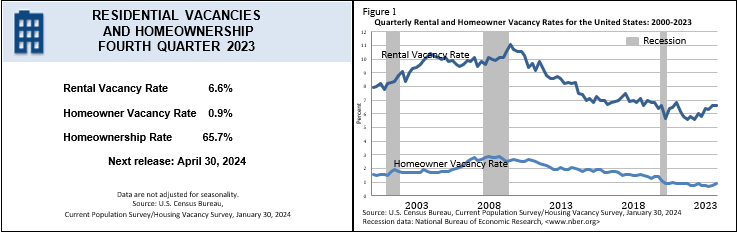

Supply and Demand – We’re Short 6,500,000 Homes

On this date last year, CNN ran an article quoting FNMA data stating that the United States is short 6,500,000 homes. The data has not improved.

Only 6.6% of rental units are vacant, only 0.9% of single-family homes are vacant. We have half the inventory of the pre-pandemic baseline. Nobody is building.

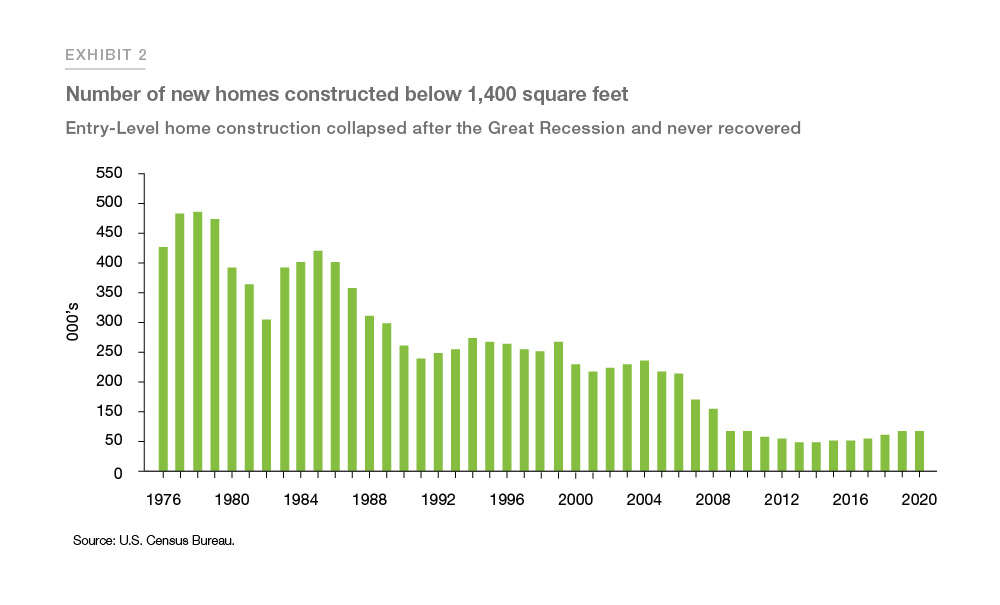

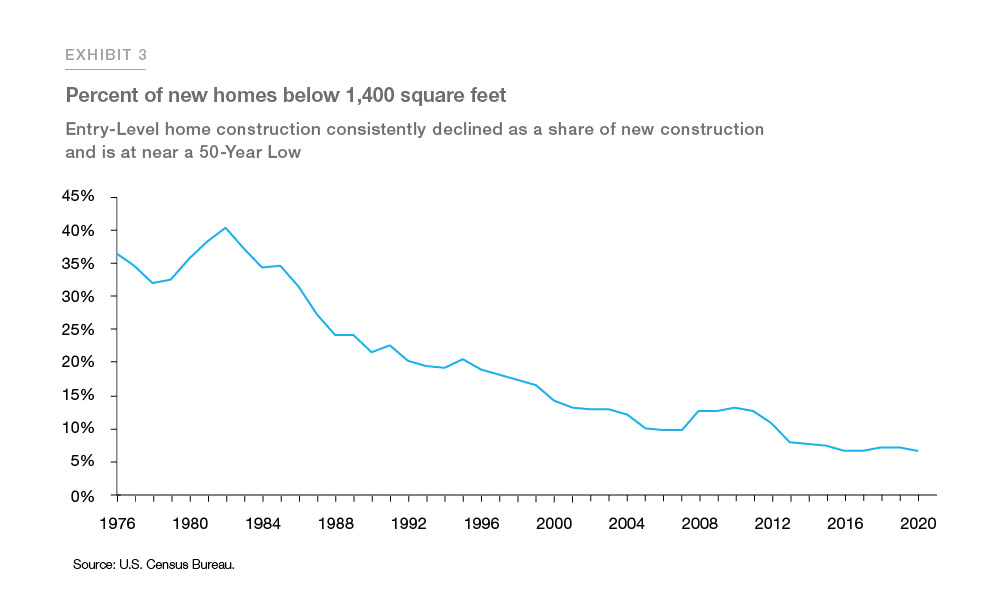

To wit, according to Fannie Mae, the main driver of the housing shortfall has been the long-term decline in the construction of single-family homes. That decline has been exacerbated by an even larger decrease in the supply of entry-level single-family homes, or starter homes. Between 1976 and 1979, the construction of new entry-level single-family homes (now defined as being 2000ft2 or smaller) averaged 418,000 units per year, or 34% of all new homes completed.

Now, no single-family homes are being constructed at all. As of 2020, the last year for which data was readily available, fewer than 5% of all new construction was affordable housing under 1400ft2. In the entire United States, in the year 2020, under 65,000 affordable homes were built. That’s about as many homes as would be needed to house a week’s worth of asylum seekers, so 1/52 of what is required.

Changing Demographics of Homeownership

During the 1980s, mortgage rates increased dramatically, rising from an average of 8.9% during the 1970s to 12.7%. The rise in mortgage rates led to a decline in housing demand and supply as housing became less affordable. As a result, entry-level housing supply fell by over 100,000 units to 314,000 units per year during the 1980s. While the overall number of new single-family homes fell, the entry-level share of all new homes constructed remained at 33%, similar to the late 1970s, indicating that entry-level supply dropped by a similar number as the overall new construction market. The above graphs bear this out dramatically.

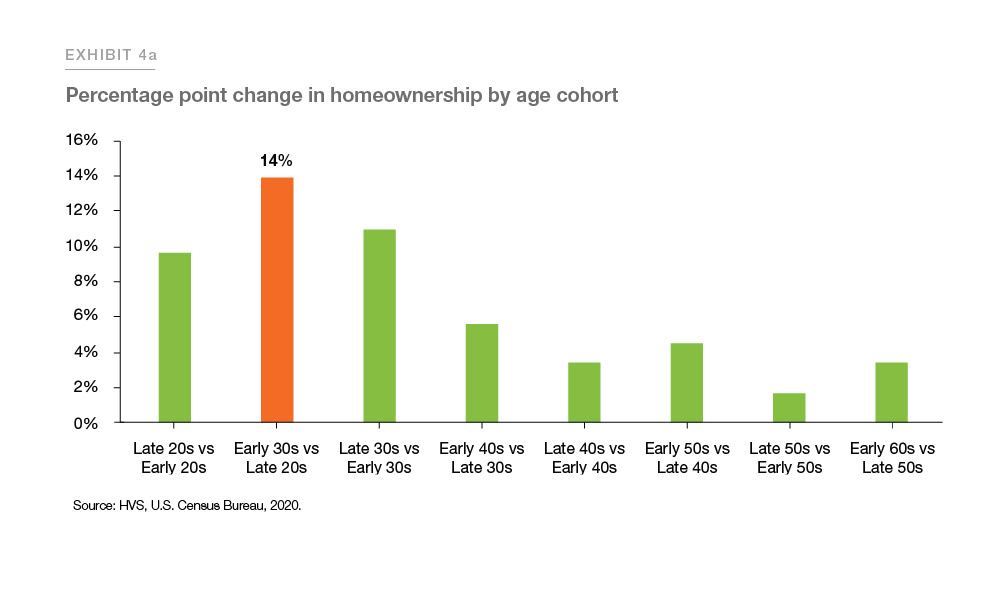

Now, we are in the market where Millenials, that generation born between 1984 and 1998, are expected to purchase their first home. Homes are now 200% as expensive for Millennial families as they were for preceding generations. This is compounded by Millennial families having less wealth, fewer opportunities, worse health, and rising global geopolitical instability. In other words, things are just peachy.

Construction is Facing an Enormous Skilled Labor Shortage

Do you know what is almost as bad as the skyrocketing need for new homes? The utter lack of tradespeople to build them. The trade union of “Associated Builders and Contractors (ABC)” estimates that the construction industry will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023. This is just to meet the demand for labor. ABC also states that the construction industry averaged more than 390,000 job openings per month in 2022, the highest level on record. One out of every 1,000 Americans could enter the construction field tomorrow and we would still not have enough workers to build the 6,500,000 homes that Americans require.

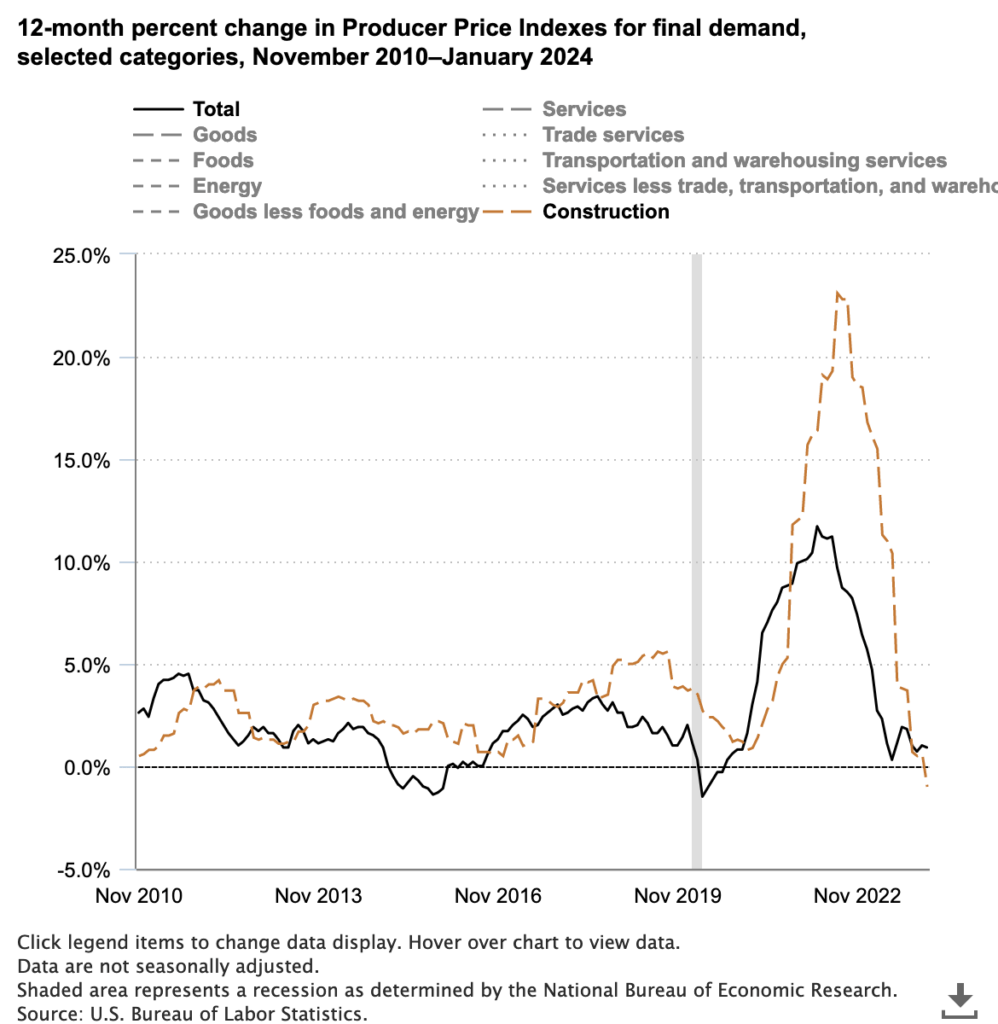

Everything is Three Times as Expensive

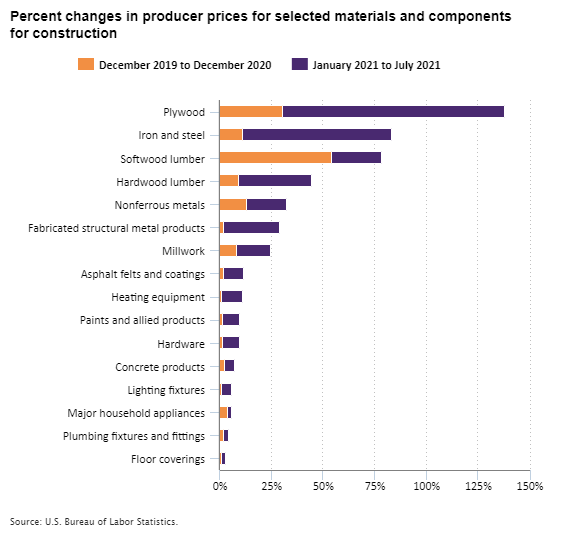

The above chart shows how the price of construction goods, and the price of the consumer economy as a whole has fluctuated in the last 13 years. Please note that each tick of this chart simply shows how much more expensive things were than 365 days ago. For fifteen years, there has been an uninterrupted annual rise in the cost of construction goods, only abated by a regression to the mean from 2022’s record-high price inflation.

As you can see from this chart, commodities used in the framing of homes have increased more than 100% since the time of the Pandemic. It is clear from the chart above this one that those costs have not yet come back to earth. We can, as a matter of reading comprehension, realize that creating a home in 2024 is probably twice as expensive as it was to create a new home in 2017. Further compounding the situation, CBRE’s 2022 Construction Cost Index forecasted a 14.1% year-over-year increase in construction costs by the end of 2022, with labor and material costs continuing to rise. The report also anticipated that cost escalation would stabilize in the 2%-4% range in 2023 and 2024, aligning with historical averages. However, overall cost inflation for materials was expected to begin cooling by the end of 2022, returning to more typical levels by mid-2023. Despite these predictions, the volatility in costs for some materials, influenced by geopolitical risks such as tariffs and sanctions, could continue. We’re seeing the low end now, but that is no guarantee.

Everything was attacked by supply chain and inflationary pressures, from carpets to paints, to timber and driveways. There is nothing left that was as affordable as it was the day Joe Biden took office. It is at this point that you, the reader, should realize there is a systemic problem in construction and housing policy in the United States that will not get better without an about-face on economic policy.

Systemic Problems in Construction and Housing Policy in the United States

Zoning and land use laws in cities like Chicago can significantly impact the price of real estate through a variety of mechanisms. Primarily, these regulations can restrict the supply of new housing by setting limitations on the types of buildings that can be constructed in certain areas, the density of developments, and the height of buildings. These restrictions can lead to a decrease in the overall number of new homes being built, which in turn contributes to a scarcity of housing and drives up prices for both buyers and renters. We’ve seen exactly the outcome we’ve expected from the laws we have passed.

One of the ways that zoning can restrict housing supply is by designating large portions of a city for single-family homes only, which limits the potential for more dense, and potentially more affordable, housing options like apartments and townhouses. Moreover, the approval processes for new developments can be lengthy and costly, which then further discourages builders from embarking on new projects, especially those aimed at the more affordable end of the market. We’ve seen exactly this occur too.

Extreme Math on Zoning Regulations and How They Effect the Price of Land

Economic research has highlighted the role of land use regulations in driving up housing prices. A study cited by the Reason Foundation discusses how regulations limiting the supply of housing have led to a divergence between construction costs and home prices since 1980. While construction costs have remained relatively stable when adjusted for inflation, housing prices have surged, particularly in areas with stringent land use regulations. This discrepancy is largely attributed to supply constraints imposed by these regulations, rather than to increases in the costs of building materials or labor. Although, as you’ve seen if you’ve read this far, the cost of materials and labor doesn’t help.

Powered By EmbedPress

If we were to examine the line of best fit, it becomes obvious that high-regulation states have more expensive real estate than low-regulation states. It becomes obvious that the regulation of local governments directly correlates to rising prices in a steady circumstance. Further, the growth of land use cases per million people almost directly parallels the earlier graphs cited herein as the Case-Schiller Pricing Index to demonstrate the inescapable reality that American homes simply are not affordable.

Glimmers of Hope

Moreover, the market has historically adapted to provide affordable housing options through processes such as filtering, where older, previously higher-income housing becomes more affordable over time. This is no longer occurring. There has been heavy-handed intervention through modern land use regulations that have curtailed these processes. By setting minimum standards for housing sizes and amenities, governing bodies have eliminated lower-cost housing options and slowed the rate at which housing becomes affordable to lower and middle-income earners. Many solutions to this have been proposed that will not cost a trillion dollars to implement, such as permitting more ADUs, classifying duplexes as R1-R3 (or RS2, RS3), or prohibiting cities from instituting single-family zoning regulations without county approval. Here in Chicago, concessions were made for the first time since 1957 to allow previously illegal units to be opened up for rental habitation just to ease the incredible demand that the lack of new construction has wrought.

Wage Stagnation is Eating the Middle Class and the Poor Alike

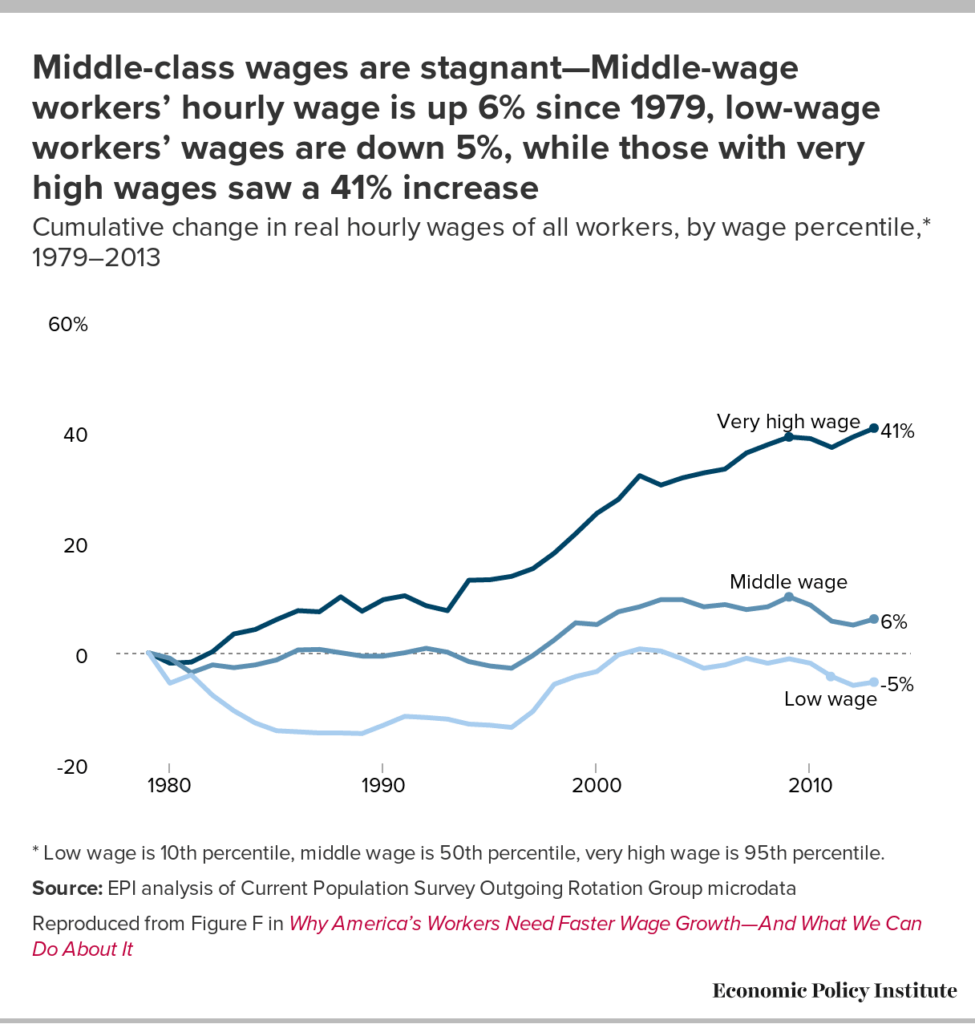

If you’re anything but the very rich, you’re living exactly as you did in 1979, except things are now orders of magnitude worse built, with more expensive materials, in worse locations, with greater governmental red tape to exist. $10,000 of tax benefits will be a drop in the bucket (about a 3.5% offset) to overcome how things have changed, but it will cost American taxpayers nearly a trillion dollars. Essentially, we would reverse wage stagnation to levels not seen since 2007 with this policy. I remember what else happened in 2007.

So Who Would Benefit from $9,600 of Mortgage Credits?

The banks. Check this out.

The latest period in time for which data is available is December 2023. At that time, there were 24,000 federally backed securities in foreclosure. There were 132,000 in serious delinquency. A further 165,000 had missed a recent payment, and 11,462,000 mortgages were being timely paid. When the government offers to give a $400/mo credit to a homeowner for a mortgage, the same homeowner will give it to a bank participating in this program to pay the mortgage. Then, the bank will report the loan as being in better standing to the government. Then the government will issue charts like this one to show how lovely the whole program is.

Except the program isn’t lovely. There are 300,000 homes on the brink in America right now because of all of these factors that I’ve spent 5,000 words describing to you. Giving 11,462,000 people $400 per month is a bribe to the banks not to the voters. If we wanted to help the people hardest hit, the federal government would not need to spend $806,400,000,000 subsidizing mortgages. It could, instead, choose to spend that money more directly and, I don’t know, reenact successful programs like HAMP or TARP. It could, very viably, also pay skilled laborers and tradespeople to get into the construction industry and sort the whole problem out themselves.

What Should We Do?

I am not a Harvard-educated economist or lobbyist. I’m someone who sells a lot of real estate. However, this is a passion-project of mine, and I’ve read some incredible books that propose great solutions. I will break those down below.

Zoning and Land Use Reforms:

Cities can legalize more apartment units by revising zoning laws that restrict much of the land to single-family homes, thereby increasing the supply of affordable housing. This can include allowing higher-density developments like townhomes and condominiums on single-family lots, as well as legalizing accessory dwelling units (ADUs) which offer more affordable, diverse housing options. Chicago has already done this quite admirably.

But there’s more that can be done. Cities can establish by-right development processes to ensure that projects meeting existing zoning laws are approved without unnecessary delays. This reduces regulatory hurdles and can significantly lower the costs associated with long, uncertain approval processes.

Reduce or Eliminate Parking Requirements:

Eliminating parking minimums can reduce construction costs significantly. Parking spaces are costly to build and often exceed actual demand. By reducing or eliminating these requirements, developers can focus resources on creating more housing units instead. We have an enormous, well-equipped CTA in the City of Chicago that tries its absolute best to get cars off the road and be greener. Why not adapt our laws to go all-in on this plan? For the sake of illustrating the sheer lunacy of the wasted space due to parking, I attach the City’s Zoning and Parking Ordinance.

Powered By EmbedPress

Implement Land Value Taxes:

Fun fact. The 1,874 single-family homes highlighted collectively pay less property taxes than the 135-unit apartment building. pic.twitter.com/NsxXHd9FvA

— Your Obed. Servant, J. B. (@Jeffinatorator) February 24, 2024

Shifting towards land value taxation can incentivize more intensive development on expensive land, making housing construction more attractive and financially feasible for developers. This can increase the housing supply, especially in city centers and near job clusters, without directly taxing taxpayer income. I have no objection to using tax planning to achieve a market result. I have great objections to bribing the lower classes and the banks to support an administrative fiat.

Use Public Land for Affordable Housing:

Cities can inventory and allocate underused public land for affordable housing projects. This approach utilizes existing resources to increase the housing supply without significant new costs to taxpayers

There is another vision as well that seeks to use Federally managed land to alleviate the housing crisis at a systemic level. Donald Trump has proposed (depending on who you ask) the construction of 10-15 planned cities across America to spur new urban development in the open frontiers and unused, sparsely populated corridors of America. I’m all for it. Look at America’s population density (97 persons/mi)! It’s a fifth of the density in Europe or China, a tenth of India or Japan, and a fifteenth of South Korea!

There is no reason for American urbanism to be as cautiously spread over the frontier of this country as it is. If we are going to spend the annual GDP of Chicago on mortgage bailouts, perhaps we could construct cities of similar splendor all across this beautiful country that would be built for affordability and community. Maybe we could finally escape the paradigms of times that no longer exist.

Conclusion

Housing prices are easily attributable not to corporate greed, but to a systemic, generations-long failure of the government of the United States to understand supply economics. There are more people than homes. Moreover, there are more people needing homes than building homes. In fact, there are fewer people building homes than practically ever before.

The land available for those homes has been regulated out of use. Moreover, where that land exists, restrictions abound to destroy the ability of competent developers to find use for it. Then, when it’s developed in such a way that will provide maximum housing, it is taxed at an outrageous rate that would make the whole experiment of affordable housing fail.

$400 per month for two years as a gift from the United States to its taxpayers is a theft from any other project that this money could fund. We’re better than giving the banks yet another bailout.