Reuters just published an article announcing a leak from the Federal Reserve about the beginning of Quantitative Tightening – https://www.reuters.com/business/calling-time-qe-central-banks-prep-synchronized-asset-cull-2022-04-19/. What, you might ask is that? For the last decade, the Banks have been adding money to their balance sheets at the end of every day. This is called Quantitative Easing. They do this through the purchase of market securities each day. In Quantitative Easing, the banks report their end-of-day balance to the Fed, then they get a cash stipend on the account. They use that money to then buy market securities like stocks and bonds. The Banks become more secure against losses and market fluctuation and the market becomes liquid.

Now, instead of doing Quantitative Easing, at the end of the COVID spending spree, we’re trying to undo it. The USA, EU, Japan, and other central banks are all going to delete money every day starting in May. Welcome to the era of Quantitative Tightening.

Table of Contents

What Will Quantitative Tightening Look Like?

So, if Quantitative Easing (QE) is the loosening of the monetary supply; then Quantitative Tightening is its restriction. Nobody really knows how this is going to work. But, the proposal is to kill $2,200,000,000,000.00 of the money supply out of existence by May 1, 2023. You read that right, $2.2 trillion dollars – enough quantitative tightening to pay the student loan debt of all Americans. The Fed, the Bank of England, CBEU, and Bank of Japan to delete the numbers on the screen that represents this money to curb the runaway inflation. I’d love to link you to an article on it, but nobody has even written an encyclopedia article on Quantitative Tightening since the words were invented two days ago.

In short, the banks are going to let bonds mature. Then, they’ll push the money back into the national debt, rather than reinvest their cash. The plan is to let balance sheets naturally decline through interest proceeds, selling securities, and remittances to the Central Bank. Each month for the next year, we’re going to evaporate $200,000,000,000 of American cash to get inflation under control and make money more scarce. This is the ultimate test of Modern Monetary Theory, and consumers will pay the price. Quantitative tightening is playing fast and loose with deflation – that little thing that caused the great depression.

Why is a Real Estate Lawyer Writing About Quantitative Tightening

Dear reader, I work in the real estate market. As such, the interest rates of mortgage loans are of paramount concern to me. I live and breathe by them. In our current era of QE, things are great. Interest rates hit 2% and hovered between 2-4% as historic lows for the last two years. You might have noticed there was a bit of a housing bubble. That’s due to the incredibly cheap capital that flowed freely during QE. The Banks have put, on average, $27,600,000,000 of absolute funny money into the economy every day during the COVID era.

How? They’re just printing it and making it freely available for banks to keep on account as the fractional reserve securities. I’m writing this article on a Wednesday, so if Banks know their balance sheets will increase by $75,000,000,000.00 before the weekend they’ll play more loosely with the funds. The purse might not be as tight if you know what I mean.

Why Quantitative Tightening is Reactionary to Inflation

Still, the government is incentivized to torch this money and get it out of the market. They do not want it to affect prices and create consequences for the ordinary consumer. The consumer, frankly, is screwed. The Fed must raise interest rates to pay its balance sheet, which creates a cycle. This cycle is a loop where the interest rates caused by Quantitative Tightening replace the price-value gap that inflation causes. The value of $1 with 8.5% inflation is $0.93. The cost of $1 is $1.07 with 7% interest rates. If $1.07 needs to be spent to get $1 in value, it’s the same value to the end buyer anyway.

Now, we’re all paying the price. Inflation is up to 8.5% – a 40-year high. Homes that cost $269,000 in 2019 are $449,000 in 2021. Everything is growing quickly out of reach to the middle class. This policy is dreadful. All it can do is push home ownership, retirement, savings, and the middle class even further out of reach. Millions of Americans and billions of people globally will feel this. This is the precipice of Depression.

The Mortgage Industry and Monetary Policy Consequences

The Fed has already started quantitative tightening by raising interest rates above 5%. There’s no end in sight to the projected rate hikes. We’re looking at at least 5 rate hikes this year, between 25 and 75 basis points. We could well see 7% interest rates as we try to get this rampant inflation under control and stabilize the monetary policy. Mortgage payments are going to creep toward the skies during 2022. I predict that FHA, VA, and USDA loans are probably just dead for the rest of the year. 7% interest rates on $160,000.00 is the same monthly payment as 5% interest rates on $200,000.00. This will severely and immediately destroy the liquidity and buyer payment to income ratio underwriting present in all loans.

The Inverted Housing Market – Where Do We Go From Here?

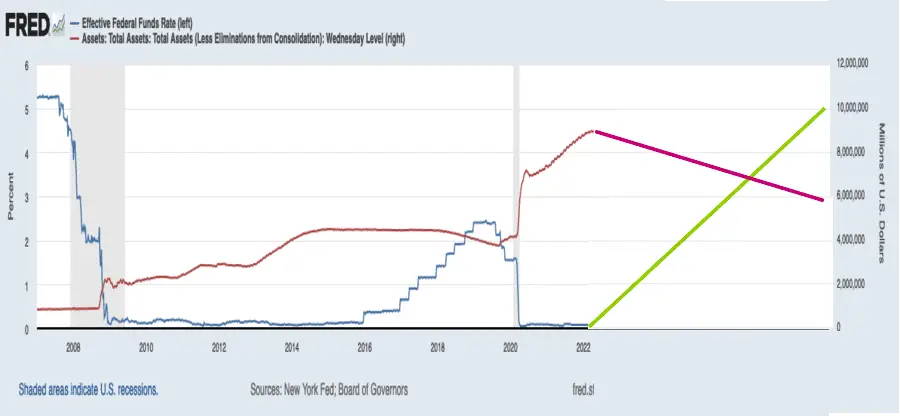

If one examines the Federal Reserve’s balance sheet, we can see that during the entire COVID era, the effective federal funds rate has been near 0%. The Fed expresses its desire to push this number to 5.5-7%, so you should chart a course for the blue on the left-hand side to be going toward the top. Similarly, the total assets held on the account are now pushing $9 trillion from $4 trillion. We know the Fed wishes to reduce the assets on account by $2.3 Trillion, and therefore can project the red line to drop to $6 trillion. Therefore, we’re going to see an inverted cross curve happen something like this:

If we look at this graph, we can see two immediate consequences. The first is that the liquidity of currency will immediately contract back to levels last seen in the bear markets of 2009 and 2017. That’s an immediate halt to the easy money roaring 2020s. Not to mention, a yield curve that represents something similar to the 2018 mini-recession. Nothing in the last 20 years looks like this precipitous drop in liquidity except the mini-crash of November 2018.

What are the Effects on Sellers?

For starters, the biggest effect on sellers of Quantitative Tightening will be the erasure of liquidity. This contraction will prompt a foreclosure panic as equities are erased. The Fed is intentionally wiping out $2.2 trillion of securities – so home equity will drop as purchasers reassess their finances and budget. Right now, buyers are happy to pay $300,000 at a 3.5% interest rate for a property because the payment is affordable at $1,600. When $1,600 monthly buys $249,000 at a 5.8% interest rate, that is what the homes worth $300,000 today will be worth – $249,000. We’re about to see a generation’s equity drop underwater as this chicanery with the money supply erases the gains of 2019 to now. Effectively, if you’re buying right now, you’re in Tulipmania.

The Market Opportunity in Bitcoin

I think we’ll also see Sellers looking to cryptocurrency as a means of purchasing properties in cash. If the currency is going to be as volatile as it’s been over the past year, then brick and mortar buyers will simply stop using it. There is now a viable alternative in the form of Bitcoin. We saw something similar to this happen in Russia in 2014 when international sanctions created a Russian foreclosure crisis. The monthly payments were decoupled from the Ruble and put onto either the Euro or Dollar. I believe it would be American arrogance to claim that it couldn’t happen here.

So, why wouldn’t sellers want to fulfill a contract in Bitcoin? During the last 8-12 months it has been more stable than the dollar. Second mover advantage argues that the opportunity field for Bitcoin in home equity is just beginning as an alternative to the reserve currency. Bitcoin’s price is effectively pegged to itself as an independent exchange and secure asset and only fluctuates against itself. If quantitative tightening truly erases equity against the monthly installment payments as I’m predicting, I don’t think many sellers will be excited to permit Fed policy to ruin their equities again.

Conclusion: Quantitative Tightening is a Horrible Idea

We are now off terra firma and into a dream of the unknown. We have left behind the conventional wisdom of economics and are playing a shell game of consumer psychology, supply and access rather than respecting the traditional property rights of those who are paying for their assets. Quantitative tightening will crunch the liquidity of buyers, which will crunch the equity of sellers and invert the housing market from bull to bear – intentionally. This is an inexcusable gamble from market makers who will one day have to answer to the millions or billions of people that feel this austerity.