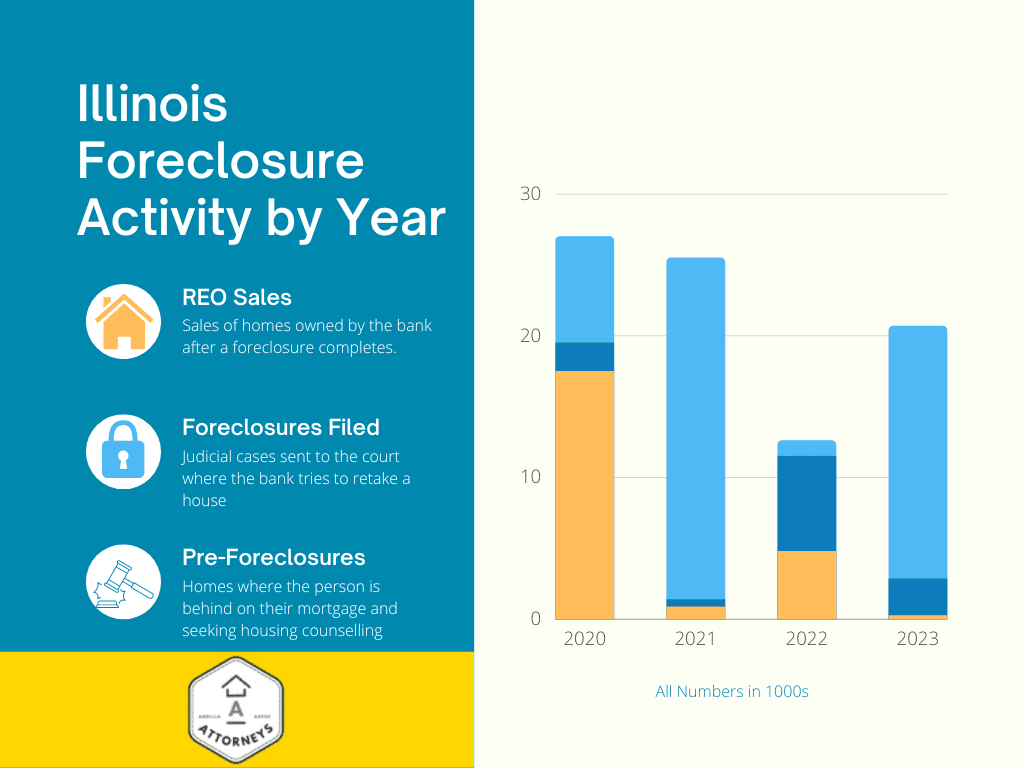

Why do people look for a foreclosure attorney? Picture this: you’ve worked hard to secure a loan to buy a property in Chicago. But life throws a curveball and suddenly, you’re unable to keep up with the mortgage payments. In this scenario, the legal term that you might dread is ‘foreclosure’. It’s a legal proceeding where a lender, like a bank, tries to reclaim the money you borrowed by selling the property you bought with the loan. Only last year, the Windy City saw foreclosure attorneys dealing with an unusually low number of cases. Fast forward to today, we’re witnessing the highest level of filings since 2015.

What does this mean for you? Well, in Illinois, most foreclosures are judicial. This implies that they involve the court system. I’ll be your guide, walking you through the Illinois foreclosure process, step-by-step.

You’re probably wondering, who am I? I’m a seasoned foreclosure attorney in Chicago, having battled over 200 cases, and successfully saved homes worth approximately $20,000,000 since our firm opened its doors. Only recently, in February 2023, I triumphed in my last foreclosure trial. As a matter of fact, I saved a home the very day I penned this article, on March 21, 2023. We are local, practicing in all seven collar counties and appearing before every judge there. Our community matters to us, and we aim to extend a helping hand. Hence, I’ve penned this series of articles decoding foreclosures, transactions subject to the mortgage, short sales, and court procedures in our city. Rest assured, we won’t charge for advice.

Table of Contents

Mortgage Foreclosure Timeline Infographic

Now, let’s decode the ‘Mortgage Foreclosure Timeline’ Infographic. When you see a photo on the left (and text to the right), it refers to Illinois judicial foreclosure. Photos on the right? These are steps you, as a homeowner, can take without a foreclosure attorney. Recognize that both scenarios unfold simultaneously.

Missed Payment Through Day 90

The PreForeclosure Period

If you start missing your mortgage payments, your lender won’t be happy. They’ll usually send you a notice of missed payments or a notice of default. By Illinois law, they must give you a 30-day “grace period” to catch up on the arrears and prevent foreclosure. During this time, as your foreclosure attorneys, we’d like to send a FDCPA Notice, buying you some precious extra weeks.

Day 91 to Day 130

Complaint is Filed – Case Begins

The case begins if you fail to clear the arrears during the grace period. Your lender will approach the court, armed with a complaint detailing the mortgage, the loan default, and the relief they seek. They’ll send a sheriff to serve you the mortgage foreclosure summons. Now is the right moment to engage your Chicago foreclosure attorney.

You must file an answer within 30 days of receiving the summons. This response should acknowledge or specifically deny the allegations in the complaint. Now you must also state any legal defenses you might have. If you fail to respond within the designated time, the court may rule against you by default..

Day 1 through Judgment

Try for a Short Sale or Deed in Lieu

The property sale can proceed with the assistance of your Chicago foreclosure attorney. You can explore all the settlement options in this article.

Day 130-Day 210+

Serious Litigation Begins

Both parties can take part in discovery, where they exchange information and documents relevant to the case. This step may not occur in every foreclosure case, especially if you haven’t filed an answer or asserted any defenses. But, a good foreclosure counsel and a thorough document review can effectively help you retain your home.

Summary Judgment: Your lender may file a motion for summary judgment if they are confident there’s no significant dispute over facts and that a judgment in their favor is warranted. If the court sides with the lender, they’ll order a foreclosure sale without a trial. The judgment outlines everything you owe – the principal balance, the interest, and the costs involved.

90 Days After Judgment

Statutory Redemption Period

llinois law provides borrowers with a redemption period – a window of time during which you can settle the debt and halt the foreclosure sale. Typically, this period spans 90 days, but it can stretch to 180 days in certain situations.

What can you do during this period? You have three options – you can pay off the loan, reinstate the loan, or sell your house. The most straightforward path is reinstatement, which involves paying off the debt and any incurred penalties.

97 Days After Judgment

Sheriff Sale (735 ILCS 5/15-1508)

If you can’t redeem the property within the redemption period, it goes under the hammer at a public auction. The highest bidder bags the property. After the foreclosure sale, the court steps in to confirm the sale, provided it was conducted in a fair and legitimate manner. Post-confirmation, the new owner receives a certificate of sale and your rights to the property are relinquished. If the sale proceeds fall short of covering the debt, the lender can seek a deficiency judgment for the remaining balance.

Facing Foreclosure? Worried About How Much it Will Cost?

Chicago Foreclosure Attorneys Don’t Always Give Free Consults… We Do.

Step 1 – Missed a Payment? Have Your Foreclosure Attorney work on a Loan Modification

Now, let’s flip the script a little and imagine you’ve missed a payment. What’s your next step? Engage your foreclosure attorney to work on a loan modification.

We’re living in tough economic times. Falling behind on bills has become commonplace. But here’s a silver lining – your mortgage won’t face foreclosure with just one missed payment. After the first missed payment, the bank earmarks your loan for pre-foreclosure and gathers the necessary paperwork. If your loan servicer has recently changed and you’re paying someone else, this could be why you’re facing problems. Despite this, missing a payment is a clear signal to contact your foreclosure attorney to avoid further complications.

A second missed payment, however, changes the scenario. The bank will send you a 30-day warning to settle your dues. In my capacity as a foreclosure attorney, I would recommend clients to consult with a HUD-approved housing counselor. More often than not, this buys them an additional 30 days to bring their account up to date.

2023 Loan Modification Guidelines

Looking at the 2023 Loan Modification Guidelines, it’s disheartening that we no longer have the HAMP and HAFA programs. The torch has been passed to Freddie Mac Flex Modifications in 2023. Resembling “Streamline” loan modifications, these aren’t a one-size-fits-all solution. But, they can prove beneficial if you’re temporarily falling behind. The eligibility rules are stringent, requiring homeowners to be less than 90 days past due, projected payment amounts not exceeding 40% of the homeowner’s income, and a loan that isn’t “underwater,” meaning the Loan to Value Ratio doesn’t surpass 100%.

What’s more, homeowners with less than 20% equity in their property have no room to negotiate interest rates. So, it’s a mixed bag, really. Nonetheless, your best bet in navigating this complex landscape is to team up with a proficient foreclosure attorney.

Understanding Foreclosure Assistance: HUD, FHA, and Veteran Programs in Chicago

The Department of Housing and Urban Development (HUD) offers free housing counseling services across the nation. If you’re grappling with foreclosure, rental problems, defaults, or credit issues, these counselors are available to lend a helping hand. To connect with a HUD-approved housing counselor in your area, simply navigate to the HUD website.

Meanwhile, if you’re a Federal Housing Administration (FHA) insured mortgage holder, you might be eligible for a loan modification program via the FHA. This initiative aims to help borrowers dodge foreclosure by reducing their monthly mortgage payments. A Chicago foreclosure attorney can guide you through this process.

Support for Veterans Facing Foreclosure

Have a loan via the Department of Veterans Affairs (VA)? You may qualify for foreclosure prevention assistance. The VA delivers financial counseling and aids in liaising with your lender to explore diverse solutions like loan modifications, repayment plans, or short sales.

Missed a payment and feel like you don’t fit into any of these loan modification categories? Don’t lose hope. I’m here to guide you through the more challenging terrain of pre-foreclosure. After all, it’s the role of a skilled Chicago foreclosure attorney to navigate these murky waters!

Step 2 – The Beginning of Illinois Mortgage Foreclosure: The Grace Period Notice

The foreclosure process in Illinois kicks off with a Grace Period Notice (GPN). This notice is a heads-up that your account has slipped into arrears and indicates the official start of the foreclosure process. In the past, banks were required by law to issue a GPN before they could even think of initiating foreclosure proceedings. However, the law in question, 735 ILCS 5/15-1502.5, has been repealed. Despite this, it’s still a widespread practice to send out a notice similar to the former statutory requirement. The language of the original notice went something like this:

“Your loan is overdue by more than 30 days. You might be struggling financially. It could be beneficial to seek approved housing counseling. A grace period of 30 days from the date of this notice has been granted to secure approved housing counseling. During this grace period, we are legally barred from initiating any legal action against you. Should you receive counseling from an approved housing counseling agency, you may be eligible for an additional 30-day grace period. The Illinois Department of Financial and Professional Regulation can provide a list of approved counseling agencies.”

Former law, 735 Illinois Compiled Statutes 5/15-1502.5

Receiving a Grace Period Notice? Connect with a Chicago Foreclosure Lawyer

Receiving a Grace Period Notice (GPN) is an unmistakable signal to contact a Chicago foreclosure lawyer. This GPN is sent to you by the bank once you’ve fallen behind on payments, indicating that they’re gearing up for potential foreclosure steps.

On the Heels of the GPN: The Notice of Intent to Accelerate

After the GPN, you may find yourself staring at a document titled “Notice of Intent to Accelerate” (NIA). The receipt of this notice signals that the bank has added you to the foreclosure pool and is calling in the entire loan as presently due. It’s the bank’s way of saying they want the total amount of the home loan paid off within 30 days or you risk foreclosure. Upon receipt of this notice, it’s crucial to engage a Chicago foreclosure lawyer and submit a Qualified Written Request (QWR). Don’t despair, though. In Illinois foreclosure, there’s an alternative path known as Reinstatement that we’ll delve into during Step 7.

Whether you landed on this page by looking up NIA or GPN, a Chicago foreclosure lawyer is here to support you. With your documentation in hand, the outlook often improves for the homeowner. So, don’t hesitate to reach out to an Illinois foreclosure attorney if your bank sends any notices your way. As knowledgeable foreclosure resolution attorneys, we can untangle the intricate legalese and help you make sense of your financial situation.

Step 3 – Planning Your Foreclosure Exit Strategy with a Chicago Foreclosure Attorney

Facing Foreclosure? Worried About How Much it Will Cost?

Chicago Foreclosure Attorneys Don’t Always Give Free Consults… We Do.

Upon receipt of the GPN, bear in mind that the bank now considers you behind on your mortgage. But don’t let panic set in! You have roughly 7 months to develop your exit strategy before the foreclosure process concludes. Numerous viable foreclosure exit strategies exist, including deed-in-lieu, consent foreclosure, short sales, reinstatements, loan modifications, accepting the proceedings, or even selling in foreclosure. Top Chicago foreclosure lawyers help you maintain control over all these strategies, ensuring you’re fully aware of your options.

Reinstatements – Getting Back on Track

Time is of the essence! Contact your lender as soon as you find yourself on the brink of foreclosure. You’ll find their phone number on the bottom left-hand corner of the last page of the foreclosure complaint. Discuss the possibility of reinstating your mortgage. They will supply the sum you need to pay to get your loan back on track. However, remember that they’re likely pursuing the above-mentioned strategies simultaneously, so you need to act swiftly to exercise your mortgage contract rights.

Secure the necessary funds to pay the stipulated amount to your lender. This includes the backlogged principal, interest, fees, and foreclosure-related costs. After making this payment, ensure you receive written confirmation from your lender that your loan is current. Maintain regular mortgage payments to stay on course and avoid slipping behind again. As for foreclosure attorney fees for reinstatement, my professional assistance typically falls below $500.00.

Choosing a Deed-in-Lieu of Foreclosure under the Illinois Mortgage Foreclosure Law

In Illinois, the simplest option is often the Deed in Lieu of Foreclosure. When both the homeowner and bank opt for a deed in lieu, the homeowner executes a quitclaim deed to the bank. The bank takes possession of the home, in exchange for waiving the entirety of foreclosure proceedings. Moreover, the bank can’t attempt to recoup any money from the homeowner via a deficiency judgment. The foreclosure process ends, and the homeowner agrees to move on.

An experienced foreclosure attorney can evaluate your specific financial situation and help you determine if a deed in lieu of foreclosure is the best option for you. A Chicago foreclosure lawyer can communicate with your lender on your behalf and negotiate the terms of the deed in lieu of foreclosure. In the last deed-in-lieu we did, we took $79,000 of debts off the file. They can help ensure that the agreement is fair and favorable to you and that you fully understand the consequences of the transaction.

Consent Foreclosure: A Swift Conclusion to Your Foreclosure Case

Consent foreclosures share many similarities with deed-in-lieu proceedings, the key distinction lies in how the bank acquires the home. In the deed-in-lieu process, the homeowner hands over the property title to the bank. However, in a consent foreclosure, the homeowner permits the sheriff to sell the house. This strategy acts as a speedy shortcut to the end of a foreclosure case, culminating in a public auction of the foreclosed home. Just like a deed-in-lieu, the bank cannot sue the homeowner for additional funds if the home’s value is underwater. As a proficient Chicago foreclosure lawyer, I could assist you in negotiating a consent foreclosure under certain conditions. We typically advise this course of action only when it can help the homeowner (our client) avoid bankruptcy.

Short Sale

On the other hand, we see Short Sales as the single best opportunity to rescue homes from foreclosure. Short sales are quite easy to pull off if you have any equity in your home whatsoever. Your foreclosure lawyer will be invaluable in helping you navigate this process. Remember, you should disclose the foreclosure when listing! Even so, there are only three common requirements that your foreclosure lawyer can help with! First, you must provide a “letter of hardship” to your lender. This letter explains why you can’t pay the mortgage anymore and need to get out from under it. Second, you will need to list the property with a real estate agent. You will need the bank’s approval on a listing price and commissions. Third, the bank will need to approve the terms of the sale. This includes the final sales price, commissions, and cash returned to you at closing.

Facing Foreclosure? Worried About How Much it Will Cost?

No Up-Front Attorneys Fees for Short Sale Sellers

Once you close, your foreclosure attorney will step into court to ensure case dismissal. We’ve found this to be the optimal route for our clients, with many pocketing some cash from the short sale. The usual hit to the credit score is about 100 points, a manageable drop. Many potential buyers actively seek foreclosed homes for quick profit, turning a negative situation into a positive one. An adept Illinois foreclosure attorney will almost always endorse short sales, as we’ve found them to be the best method to rebuild your credit amid foreclosures.

Find an Investor to Buy Your House

If you’re facing foreclosure and want to sell your house to an investor, you’ll need to market your property effectively to attract the right buyer. Here are some steps to help you market your home to an investor. Start by researching local real estate investors who are active in your area. Look for real estate investment companies, wholesalers, or individuals who buy properties for cash or as-is. You can find them through online searches, local real estate investment clubs, or by asking for recommendations from real estate agents or other professionals. You’ll need to price your property competitively. Don’t use free tools to do this, hire a professional.

When marketing your property, be upfront about the foreclosure situation. This helps set expectations for potential buyers and demonstrates that you’re motivated to sell quickly. It also allows investors to factor in the time constraints and plan accordingly. Investors typically prefer a fast closing process. If possible, be prepared to close the sale quickly, as this can be a significant selling point. Investors may have specific requirements or preferences when it comes to the terms of the sale, such as assuming existing liens or paying cash. Be open to negotiating these terms to reach an agreement that works for both parties.

Navigating the Courtroom: Strategies from Foreclosure Attorneys

Inevitably, if we cannot resolve the foreclosure issue outside court, our battle shifts to the courtroom. A variety of options remain viable during an Illinois courtroom foreclosure case. Despite preferring out-of-court solutions, as Illinois Foreclosure Lawyers, we understand that court appearances can sometimes be unavoidable. When a court becomes a necessity, our strategy revolves around challenging procedures, scrutinizing payment history, and disputing the Bank’s ownership of the Note. Although this approach often serves as a final effort to gain leverage for a settlement, it is a crucial step.

While we recognize that some attorneys advocate a “show me the note” defense, we strive to avoid this strategy as it can accumulate unnecessary bills for our clients. Keep in mind that during an active foreclosure case, you bear the cost for both your attorney and the Bank’s attorney. As such, swiftly moving the case forward and minimizing costs becomes paramount. I’ve witnessed a client being charged as much as $36,000 in legal fees during a foreclosure! Our approach is strictly cost-effective, ensuring we do what’s financially best for our clients. We’ll delve deeper into this in Step 6.

Step 4 – Receiving the Foreclosure Summons

Upon filing a Mortgage Foreclosure Complaint, the Bank must dispatch a summons and deliver you a copy of the Complaint. If you just were handed a 35 page document by someone who came to the door, this is absolutely where you should start reading. This mortgage foreclosure summons alerts homeowners that they need to respond to the lawsuit’s claims. Everyone who has borrowed on the loan and currently resides in the home is issued a summons. In Illinois, other lienholders on the property, along with a catch-all party referred to as “Unknown Owners and Non-Record claimants,” are also named. Your foreclosure attorney can decipher this document and outline the sum the bank is demanding.

In Illinois, the Summons grants you 30 days from receipt to appear, answer or otherwise plead. You will also likely receive a notice to appear for court-sponsored mediation. If you reside in Kane County, Cook County, Will County, or Lake County, you should absolutely utilize the mediation programs. The DuPage Housing Authority runs the programs in DuPage County, and they remain a viable point of contact.

Why a Foreclosure Attorney is Crucial, Not an Auditor

Upon receiving your summons, reaching out to an Illinois foreclosure attorney is a must. The Summons signals the commencement of severe legal action against you, potentially costing you massive credit score points and thousands of dollars. Only an attorney is qualified to represent you in court on these matters. In Illinois, neither a housing counselor nor a forensic foreclosure auditor can appear in court without a law license. If you have received this document, it’s a must to hire a lawyer.

Step 5 – Participating in Court-Sponsored Mediation with a Foreclosure Attorney

Mediation serves as a platform for the homeowner and the Bank to collaborate toward a foreclosure solution outside court. As foreclosure lawyers in Chicago, we invest significant time in mediation. Mediation proves to be the most promising route to find settlements that prevent a total loss. Whether your goal is a loan modification, short sale, deed-in-lieu, or consent foreclosure, mediation programs expedite the collaboration toward a swift settlement. Furthermore, mediation sessions are confidential, and the mediator lacks the authority to impose any agreement upon the parties.

Where to Go for Foreclosure Mediation

The mediation process commences with preliminary scrutiny of your financials and your repayment capability. As highlighted in Step 1, consulting a HUD Approved Housing Counselor to understand the documents that best represent your financial status can be beneficial. Your foreclosure attorney will guide you in interpreting these documents and estimating your repayment ability. Bring along your tax returns, pay stubs, and monthly bills. Your foreclosure attorney must demonstrate your monthly income available to service your home loan (or why you can’t afford it).

Cook County gives access to housing counselors and foreclosure legal assistance at each judge’s respective help desk and from time to time on the 7th floor of the Daley Center. I can tell you as a Chicago Foreclosure Lawyer you should call (877) 895-2244 for details. Kane County has a mandatory opt-out mediation program. You will be given a mediation date, and as long as you appear, you can participate in the court-sponsored mediation. Will County is similar to Kane County’s program, but your date to appear is listed on the Complaint itself. Lake County‘s program is an opt-in program where homeowners can use the Court Sponsored mediation program so long as they attend an education session offered by the Affordable Housing Corporation within 35 days of receipt of the summons. They can be reached at (847) 796-8050.

The Step-by-Step Guide to Foreclosure – Justin Abdilla (own work) on avvo.com

Facing Foreclosure? Worried About How Much it Will Cost?

Chicago Foreclosure Attorneys Don’t Always Give Free Consults… We Do.

Disposing of Foreclosure Through Mediation – The Role of a Great Foreclosure Attorney

Should mediation succeed, an agreement with the bank emerges. It could include receiving a loan modification, securing your home via a new HAMP modification, or entering a trial payment plan. Alternatively, you might agree on short sale numbers or a consent foreclosure, deciding to hand over your home to a new buyer or back to the Bank. At this juncture, an experienced Illinois Foreclosure lawyer becomes instrumental in formulating a plan leading to a settlement.

On the other hand, if mediation fails to resolve the issues, the court sets a status date for your foreclosure. This return date may be the date indicated on your original summons. Typically, 30 days after the mediation program sends a letter declaring the termination of mediation, your foreclosure attorney should file your first response. If you opted out of mediation, you are obligated to respond to the Court within 30 days of receiving the summons.

Step 6 – Using your Foreclosure Attorney in Court

Filing an Appearance (the form bearing your address) and another pleading form part of your obligation to the Court. As a starting point, you can file an answer, which scrutinizes the Complaint line by line, either admitting or denying the allegations, including implied ones. Alternatively, you could file a motion to dismiss if the Complaint is defective. It is strongly recommended to engage a foreclosure attorney for filing these documents as incorrect submission could result in the loss of many of your rights.

Decoding Illinois Foreclosure Motions to Dismiss

Before setting foot in the courtroom, homeowners should seek counsel from an attorney to identify any defects in the service of the Complaint or those visible on the face of the Complaint. These “use it or lose it” motions to dismiss must be raised at the earliest opportunity; otherwise, you forfeit them. These motions, referred to as 2-615 motions, are purely procedural.

Nonetheless, other motions to dismiss exist, claiming, for example, “This is the wrong bank” or “This loan was discharged in bankruptcy.” If such motions to dismiss apply to you, your foreclosure attorney will identify and file them on your behalf. These 2-619 motions are factual and must be substantiated with evidence.

Regardless of the situation, your response must be filed within 30 days of the mediation date. As dedicated Chicago Foreclosure lawyers, we endeavor to assist all our foreclosure clients, be it in court or through a collaborative settlement. Feel free to reach out to us for case-specific queries and a free consultation with an attorney.

Facing Foreclosure? Worried About How Much it Will Cost?

Chicago Foreclosure Attorneys Don’t Always Give Free Consults… We Do.

Defending a Foreclosure Summary Judgment

A detailed account of how your foreclosure attorney defends your case in Court will be covered in a subsequent article. To summarize, we help you save significantly. My responsibilities include analyzing your payment history, verifying if the Bank charged you interest correctly, compelling the Bank to produce your original signed documents as proof of loan ownership, identifying the right person to negotiate your loan exit, and extending your sales dates in case of hardship. Foreclosure attorneys can significantly mitigate the financial distress, contributing significantly to your family’s exit strategy.

Step 7 – Reinstatement, the Last Chance to Halt the Foreclosure

If all else fails, your Chicago foreclosure lawyer will recommend one final step that you can take to resolve the foreclosure without a judge. In Illinois, you have an absolute right to reinstate your loan within 90 days of the foreclosure complaint. While this can often cost upwards of $10,000 it is the only guaranteed way to get out of the courtroom. Keep in mind you will have to pay all your back-owed mortgage principal, the interest, the escrow fees, and the attorney fees. My fees are pretty affordable here, only about $500 in most cases. Anyone else who has a lien that crept up might need to get paid too. While it certainly isn’t cheap, certainty is often worth it. If you ever do wish to reinstate the loan, your Illinois foreclosure attorney will know exactly which number to call to get an up-to-date figure.

Conclusion – Foreclosure Attorneys Provide Value!

I hope this article has demonstrated the dozens of ways that a Chicago foreclosure lawyer will give you a soft landing from your financial problems. While we can’t always save the home, we can often help it not hurt so much. Whether we’re getting a short sale to minimize the credit score hit, or a consent foreclosure to get you more time, we’re always working for our clients. The service is very affordable and often generates a positive return on investment for our homeowner clients. If you are facing foreclosure in Illinois, give me a call today and I’ll tell you everything I can do for you.

Resources:

Hud Approved Counselors, Illinois – Retrieved June 8, 2020

AOIC Foreclosure Approved Forms – Retrieved June 8, 2020