Table of Contents

Introduction

When you take out a mortgage, you’re committing to making regular payments over a set period of time – but what if you could cut your mortgage in half? In the past two years, the interest on those payments has gone from 3% to 7%. Some commercial loans are even 10%. However, did you know that making extra payments can have a significant impact on the amount of interest you pay and the length of your mortgage? In this article, we’ll explore the benefits and drawbacks of making extra payments and provide strategies for doing so effectively.

How Extra Payments Affect Your Mortgage

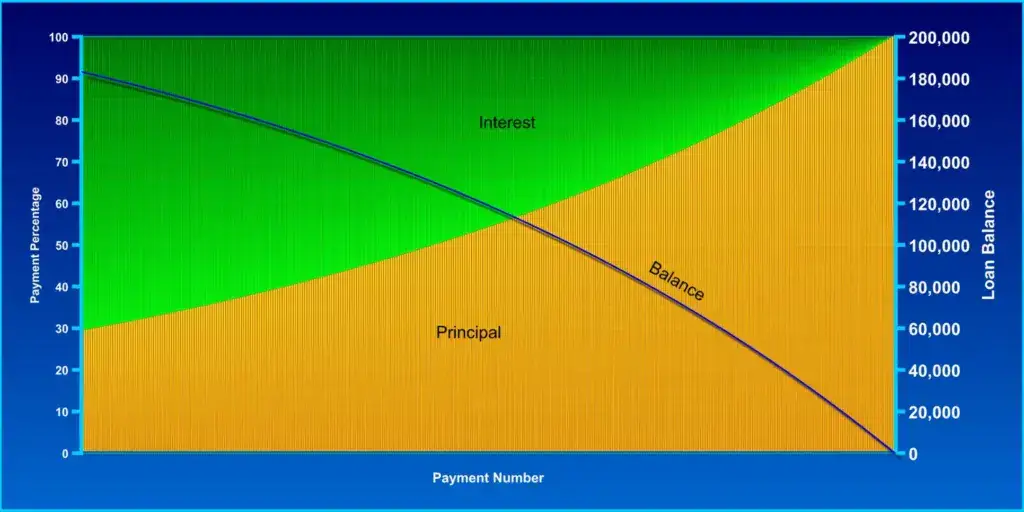

To understand the impact of extra payments, it’s essential to first understand how interest works on a mortgage. When you make a mortgage payment, a portion of it goes towards paying down the principal (the amount you borrowed) and the rest goes towards paying interest. Over time, as you make payments, the portion that goes towards interest decreases, and the amount that goes toward the principal increases.

By making extra payments, you reduce the principal faster, which means less interest accrues over time. As a result, you’ll pay less in interest over the life of the loan. Additionally, making extra payments can also reduce the length of your mortgage. For example, if you make an extra payment of $1000 per year on a 30-year mortgage with a 4% interest rate, you could potentially shave off over 5 years of payments.

Effective Buyers Counsel for a Fraction of the Price of the Other Firms

$500 Attorneys Fees Flat for a Buy Side Closing

Why do I Want to Pay the Principal but Not Pay the Interest

Paying extra interest than you absolutely need to pay can be disadvantageous for several reasons:

- Increased overall cost: Extra interest payments increase the overall cost of borrowing. The more interest you pay, the more expensive your loan becomes. By minimizing interest payments, you can save money over the life of the loan.

- Slower principal reduction: Paying extra interest means you’re not directing as much money towards reducing the principal balance of the loan. As a result, it takes longer to pay off the loan, prolonging your debt and leading to more interest payments over time.

- Opportunity cost: The money spent on extra interest could be used for other financial goals or investments. By paying additional interest, you miss out on the opportunity to allocate those funds to retirement savings, emergency funds, or other investments that could potentially generate a higher return.

- Strained cash flow: Extra interest payments can put a strain on your monthly cash flow, making it more challenging to cover living expenses or save for other financial goals.

- Reduced financial flexibility: Paying extra interest may limit your financial flexibility, making it harder to refinance the loan or sell the property in case of a mortgage. It could also reduce your chances of qualifying for better loan terms in the future.

Instead of paying extra interest, it’s often better to focus on reducing the principal balance of your loan by making additional principal payments when possible. This approach can help you save money on interest payments, shorten the loan term, and improve your overall financial health.

Making Extra Payments to Cut Years off Your Mortgage

There are several strategies for making extra payments on your mortgage.

When making an extra payment, it’s essential to specify that you want the additional amount applied to the principal balance of your mortgage. Otherwise, the lender might apply the extra payment to future monthly payments, which won’t help in reducing the principal balance as quickly. This can be seen in the Note and Mortgage you’ll sign at closing.

One common method is to make biweekly payments instead of monthly payments. By doing so, you’ll make an extra payment each year, which can significantly reduce the amount of interest you pay over time. It’s pretty clever. If you have 12 months in a year, that’s 12 payments. But there are 13 months if you pay every 4 weeks.

Another strategy is to round up your payments. For example, if your monthly payment is $876, you could round up to $900 or $1000. Lastly, you could make lump sum payments, such as using your tax refund or a work bonus to make an extra payment. Most mortgages don’t hit you for making a big ‘ol payment.

Effective Buyers Counsel for a Fraction of the Price of the Other Firms

$500 Attorneys Fees Flat for a Buy Side Closing

The Benefits of Extra Payments to Cut Your Mortgage

The benefits of making extra payments are clear. By reducing the amount of interest you pay, you’ll save money over the life of the loan. Additionally, making extra payments can shorten the length of your mortgage, which means you’ll own your home outright sooner. Lastly, by paying down the principal faster, you’ll increase the equity in your home.

The Drawbacks of Extra Payments

While making extra payments can be a smart financial move, it’s important to consider the potential drawbacks. For example, if you have other debts or financial goals, such as saving for retirement, you may be better off investing your extra money elsewhere. Additionally, making extra payments can impact your cash flow, which could make it difficult to meet other financial obligations. Finally, some mortgages may have prepayment penalties, which can negate the benefits of making extra payments.

FAQs

a. How often should I make extra payments?

The frequency of extra payments depends on your financial situation and goals. Some people choose to make biweekly payments, while others make lump sum payments whenever they have extra money. Consider your budget and goals to determine the best approach for you.

b. Should I use a mortgage calculator to figure out how much I’m going to cut my mortgage?

Yes, using a mortgage calculator can help you determine how extra payments will impact the length of your mortgage and the amount of interest you’ll pay. There are many free calculators available online.

c. What happens if I miss an extra payment?

If you miss an extra payment, your mortgage will continue as normal. However, you won’t get the benefits of making extra payments, such as reduced interest costs and a shorter mortgage term.

d. Is it worth making payments on my mortgage?

Whether or not it’s worth making extra payments depends on your financial situation and goals. Consider the benefits and drawbacks discussed in this article, and consult with a financial advisor if you’re unsure.

e. Can I stop making extra payments once I start cutting my mortgage?

Yes, you can stop making extra payments at any time. However, if you’ve already made extra payments, you’ll have already reduced the amount of interest you pay over the life of the loan.

f. Are there any penalties for making extra payments to cut down a mortgage?

Some mortgages have prepayment penalties, which are fees charged if you pay off the loan early. However, many mortgages do not have prepayment penalties, so it’s important to check with your lender.

g. Can making extra payments on a mortgage cut the loan in half?

While making extra payments can significantly reduce the amount of interest you pay and shorten the length of your mortgage, it’s unlikely that it will cut your loan in half. However, making extra payments can save you thousands of dollars over the life of the loan and help you build equity in your home faster.

Conclusion

Making extra payments on your mortgage can be a smart financial move if you’re looking to reduce the amount of interest you pay and shorten the length of your mortgage. However, it’s important to consider the potential drawbacks, such as the impact on cash flow and prepayment penalties. Ultimately, whether or not making extra payments is worth it depends on your financial situation and goals. We encourage you to assess your own mortgage situation and consider making extra payments if it aligns with your goals.