Selling a house as is can be tempting for homeowners who want to avoid making repairs and updates before putting their property on the market. However, while selling a house in its current condition may seem like a hassle-free option, it can end up costing more in the long run. As a seasoned Chicago attorney specializing in real estate transactions, I understand that selling a house can be a challenging and emotionally charged process. Many homeowners dread the thought of having to invest time and money into repairs and updates before listing their property. In this article, we’ll take a closer look at the real cost of selling your house “as is” and explore alternative options.

Table of Contents

Introduction

Selling a house can be a complex and emotional process, and for many homeowners, the idea of making repairs and updates before putting their property on the market can be overwhelming. As a result, selling a house “as is” may seem like an attractive option.

Selling your house “as is” can seem like an attractive option if you are looking to sell your house quickly or if you don’t want to invest money in repairs or renovations. However, before you decide to sell your house “as is,” it is important to understand the real cost of this decision.

At first glance, selling your house “as-is” might appear to be a savvy move. However, this approach could actually end up costing you more money in the long run. In this article, we’ll delve into the real cost of selling your house “as-is” and discuss alternative options to help you make an informed decision that best suits your needs. So, if you’re searching for “Selling a house as-is” on Google, you’ve come to the right place for expert advice.

Understanding Selling a House “as is” Sales

When a homeowner sells a house “as is,” they’re essentially telling potential buyers that they won’t be making any repairs or updates before the sale. Importantly, this comes up a lot in Paragraph 12 and Paragraph 36 of the Multiboard 7.0 Real Estate Contract. While this can be appealing to buyers who are looking for a fixer-upper or who want to save money on the purchase price, it also means that the seller is absolving themselves of any responsibility for the condition of the property.

What Will This Sale Cost Me – A Closing Cost Breakdown?

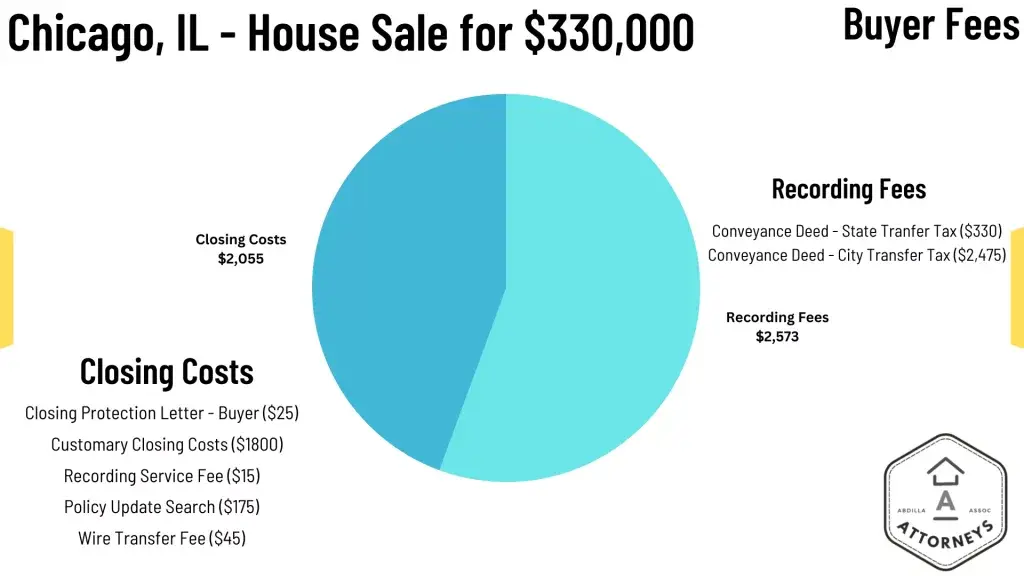

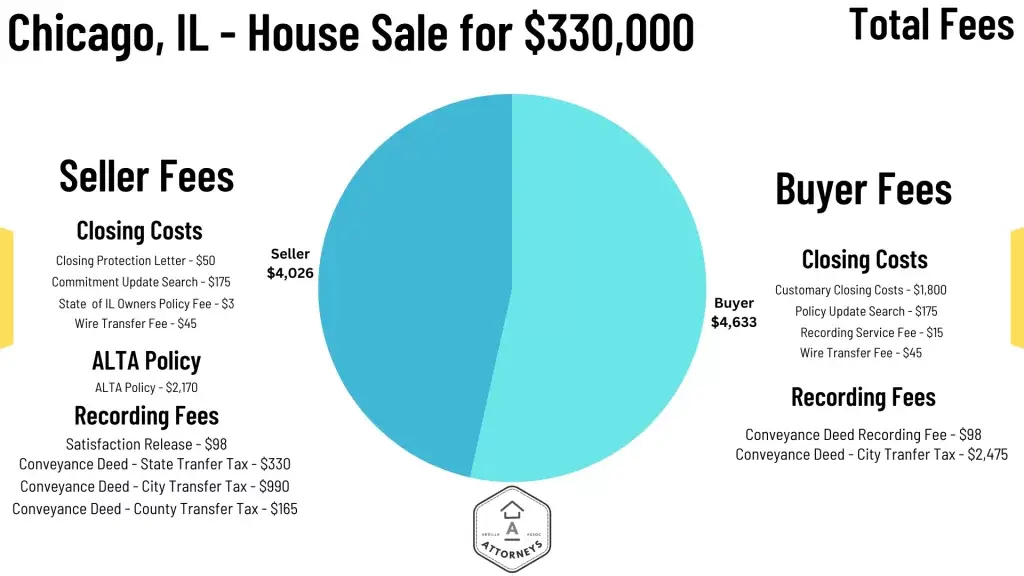

Closing costs can be divided into two main categories: buyer’s costs and seller’s costs. While some costs are specific to either the buyer or seller, others may be negotiable between the two parties. While selling a house “as is” may seem like an easy and cost-effective option, there are several hidden costs that homeowners should be aware of. We’re using an average price of $330,000 for home sales. With this, we will break down every cost for selling a house as-is in the diagrams below.

Buyer Costs – How to Negotiate Against an As-Is Buyer

First, Buyer’s closing costs typically include fees related to obtaining a mortgage, such as loan origination fees, discount points, and credit report fees. Additionally, buyers may be responsible for costs associated with property appraisal, title search and insurance, escrow fees, and prepaid expenses.

So, the Buyers will be covering a majority of the Recording Fees, including the City and State Transfer Tax. Your Customary Closing Costs.

Customary Closing Costs “means the following customary and reasonable costs a seller incurs in the sale of real property: title insurance and endorsements premium; abstracting and title examination costs; recording fees; documentary fee; certificate of taxes fee; survey costs; credit report fee; appraisal fee; broker’s fee; attorneys’ fees; title insurance company document preparation and closing fees; and any other closing costs that would ordinarily result in the reduction of a seller’s basis in the real property being sold for the purpose of determining any capital gain under the Internal Revenue Code.”

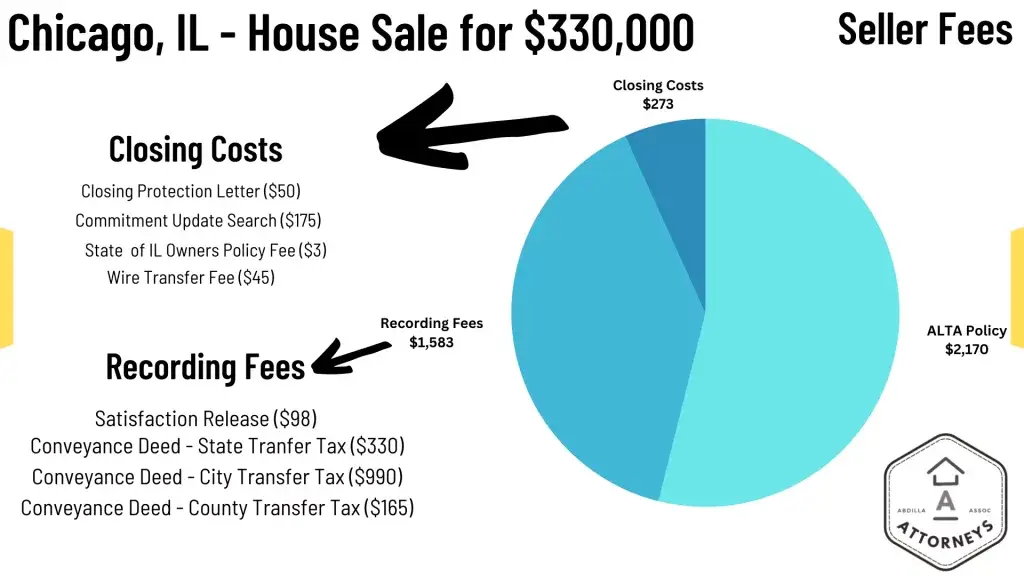

Next, we’ll take a look at the Seller’s Costs

Seller Costs – Your As-Is Sale Expenses

Second, we can discuss the seller’s costs – your costs. Crucially, this is where you will make or break your profit margins when selling your house as is. These often consist of fees for title transfer fees and prorated property taxes. The seller may also agree to pay some of the buyer’s closing costs as part of the negotiation process.

Sell Your House As Is With Me for No Attorneys Fees

$0 Attorneys Fees for Selling a House As Is

ALTA Owner’s Policy – Your Protection for Selling a House As Is

An ALTA owner’s policy is a type of title insurance policy that protects the buyer of an estate or interest in land from defects and liens in the history of the title. This is paid for by the Seller. For the example that we’re using, a house that would sell for around $330,000 would have a rate of $2,170 to match the Liability Amount.

Title services involve a two-step process: the title search and obtaining title insurance.

- Title Search A title search is an examination of public records to confirm the legal ownership of the property and to identify any outstanding liens or encumbrances.

- Title Insurance Title insurance protects the buyer and lender from potential issues with the property’s title, such as undisclosed liens or ownership disputes.

In total, the breakdown should look like this.

| Closing Cost Fees | Party Responsible | Amount |

| Commitment Update Search | Seller | $175 |

| Policy Update Search | Buyer | $175 |

| Recording Service Fee | Buyer | $15 |

| State of IL Owners Policy Fee | Seller | $3 |

| Wire Transfer Fee | Both | $45 |

| Closing Protection Letter | Both | Buyer: $25 Seller: $50 |

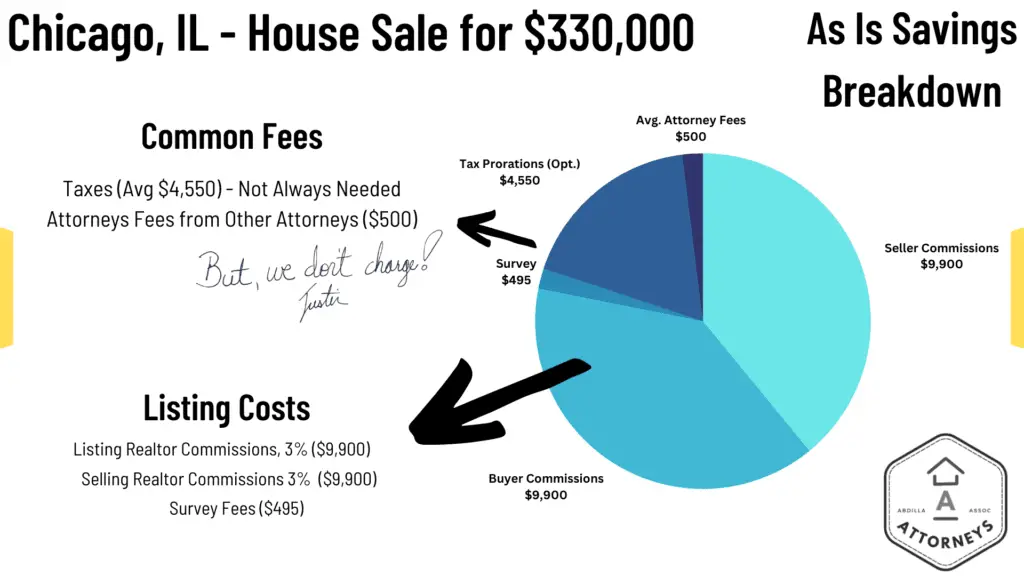

So What Fees Will I Save Selling As-Is or For Sale by Owner?

Sell Your House As Is With Me for No Attorneys Fees

$0 Attorneys Fees for Selling a House As Is

What are some things to consider for a FSBO when Selling a House As Is?

Here are the top three things to consider when you are selling your house FSBO.

Lower sale price – By up to 30%

Selling a house “as is” can significantly lower the sale price, as buyers will factor in the cost of repairs and updates that they’ll need to make after purchasing the property.

Longer time on the market when you sell a house as is

Houses sold “as is” tend to spend longer on the market than houses that have been updated and repaired. This is because buyers may be hesitant to purchase a property that requires a lot of work. Further, many people choose not to use a realtor when selling a house as is.

Buyers who are interested in an “as is” property are often looking for a bargain, which can lead to increased negotiation and a lower sale price for the seller.

Possible Future Lawsuits When You Sell A House As Is

If a buyer discovers major issues with the property after purchasing it “as is,” the seller may be liable for any damages or repairs that are required. We have some extensive resources on real estate disclosures.

How do you determine if an “as is” sale is right for you?

If you’re considering selling your house “as is,” there are several factors to consider:

Your timeline

If you need to sell your house quickly, selling “as is” may be the best option. However, if you have more time to make repairs and updates, you may be able to sell for a higher price.

The condition of your house

If your house requires major repairs or updates, selling “as is” may be the most realistic option. However, if your house is in relatively good condition, it may be worth investing in repairs and updates to increase the sale price.

Your financial situation

Selling “as is” may be the best option if you can’t afford to make repairs and updates before the sale. However, if you have the financial means to invest in your property, you may be able to sell for a higher price. As Is sales are often attractive for sellers facing foreclosure.

Sell Your House As Is With Me for No Attorneys Fees

$0 Attorneys Fees for Selling a House As Is

Alternatives to selling “as is”

If you’re hesitant to sell your house “as is,” there are several alternatives to consider:

The condition of the home

The condition of your home is a key factor to consider when deciding whether to sell “as is.” If your home requires major repairs or updates, selling “as is” may be the most realistic option. However, if your home is in relatively good condition, investing in repairs and updates can significantly increase the sale price. Here are some things to consider:

Major repairs

If your home requires major repairs such as a new roof, foundation repairs, or HVAC replacement, selling “as is” may be the most realistic option. These repairs can be expensive and time-consuming, and may turn off potential buyers who are looking for a move-in ready property.

Cosmetic updates

If your home is in good structural condition but requires cosmetic updates such as new paint, flooring, or fixtures, investing in these updates can significantly increase the sale price. These updates can be relatively inexpensive and can give your home a fresh, modern look that may attract more buyers.

Curb appeal

The first impression that your home makes on potential buyers can have a big impact on their decision to make an offer. Improving your home’s curb appeal by trimming trees and bushes, planting flowers, and power washing the exterior can make a big difference in how your home is perceived.

Safety issues

If your home has safety issues such as mold, lead paint, or asbestos, these issues will need to be addressed before you can sell. These issues can be expensive to remediate, but failing to address them can put you at legal risk and may deter potential buyers.

By carefully evaluating the condition of your home and weighing the costs and benefits of making repairs and updates, you can make an informed decision about whether to sell “as is” or invest in your home to increase its sale price.

The type of buyer

It’s important to consider the type of buyer that may be interested in purchasing an “as is” property. Generally, these buyers fall into one of the following categories:

Investors

Real estate investors often purchase properties “as is” with the intention of renovating and reselling them for a profit. These buyers may be willing to offer a cash sale with a quick closing time, but be prepared to sell for a lower price than you would get on the open market.

DIY enthusiasts might help you with Selling a House As Is

Buyers who are looking for a fixer-upper and who are handy with DIY projects may be interested in an “as is” property. However, these buyers may also be looking for a bargain and may be more inclined to negotiate on the sale price. But, these buyers are a good resource to figure out the price of repairs on the home so you can best adjust its after-repair values.

First-time homebuyers

First-time homebuyers who are on a tight budget may be attracted to “as is” properties, as they may be able to purchase a property at a lower price and use the money saved to make repairs and updates over time. However, these buyers may also be more hesitant to purchase a property that requires a lot of work.

Bargain hunters and Wholesalers

Buyers who are looking for a bargain may be attracted to “as is” properties, as they may be able to purchase a property at a lower price than they would on the open market. However, these buyers may also be more likely to negotiate on the sale price and may be less likely to make a full-price offer.

Stage your house

Staging your house can help potential buyers see its potential and increase its perceived value. This can lead to a higher sale price and a quicker sale.

Conclusion for Selling a House As Is

Selling your house “as is” may seem like an easy and cost-effective option, but it’s important to understand the potential costs and drawbacks before making a decision. By considering alternatives such as making repairs and updates, staging your house, or selling to a real estate investor or traditional buyer, you may be able to achieve a higher sale price and a smoother transaction.

FAQs

How can I determine if my house requires major repairs to sell as is?

Consider hiring a professional inspector to evaluate your house and provide a report on its condition.

Can I still negotiate on the sale price if I’m selling a house “as is”?

Yes, buyers may still be willing to negotiate on the sale price of an “as is” property.

Can I sell my house “as is” if it has a mortgage?

Yes, you can still sell your house “as is” if it has a mortgage. However, you will need to pay off the remaining balance on the mortgage before completing the sale.

Sell Your House As Is With Me for No Attorneys Fees