When you sell a business or investment property and make money, you usually have to pay taxes right away. But there’s a special rule, called IRC Section 1031, that lets you delay paying taxes if you use the money to buy a similar property. If you want a tax-deferred exchange in 2023, know that the 1031 Exchange Rules are strict, but there are a couple of ways to structure this transaction. Not only can you buy the property now, and sell the swap property later, like a reverse 1031 exchange. But also, you can sell what you’ve got and buy the target later, that’s known as a deferred 1031 exchange in 2023. You can simply trade deeds, that’s a simultaneous 1031 exchange. Or, you can be a really complicated client and go for a 1031 construction and renovation exchange. Just remember, even though you don’t have to pay taxes now, you might have to pay them later when you sell the new property.

Tax Deferred Exchanges occur when you trade one property for another. To that pot, you can add cash, debts, and other property (like private jets). If you get cash, pay off debts, or get other property, you might have to pay some taxes during the year. Sometimes, a single trade can have both delayed taxes and taxes you have to pay right away if you swap for a less valuable property. We’re going to go over every type of 1031 exchange and how to save money.

Table of Contents

Essential 1031 Vocabulary

A 1031 exchange (also known as a like-kind exchange or Starker exchange) is when you trade one investment property for another. Usually, these trades are taxed like sales, but if your trade follows the 1031 rules, you won’t have to pay tax or will only pay a little tax when you trade.

This means you can change your investment without the IRS thinking you’re making money from it. Your investment can keep growing without being taxed. You can do 1031 exchanges as many times as you want, moving your profit from one property to another. You’ll only pay tax when you finally sell a property for cash. If everything goes well, you’ll only pay tax once at a low rate.

Save 25% on Your Tax Bill When You do a 1031 Exchange on Your Investment Property

No Additional Attorneys Fees for Sellers Doing 1031 Exchanges

Like-Kind Exchange

To qualify, the properties in the trade just need to be “like-kind,” which means they can be different types of properties. You can trade an apartment building for empty land or a farm for a shopping center. The rules are pretty flexible. You can even trade one business for another, but you have to be careful not to make mistakes.

The 1031 rule is for investment and business properties. You usually can’t use a 1031 exchange for your main home because you live there and it’s not an investment. But if you rent it out for a while and don’t live there, it could become an investment property and be eligible. If you want to change who owns the new property after a tax-deferred exchange, it’s better to wait a few years. If you get rid of it quickly, the IRS might think you didn’t plan to keep it as an investment, which is important for 1031 exchanges. Sometimes it can be used for homes you used to live in or vacation homes, but there are more rules you have to follow for those.

Vacation Home 1031 Rules

People used to swap vacation homes using the 1031 rule, then live in the new home and later use a tax break for selling their main home. Congress changed the rules in 2004, but you can still turn vacation homes into rental properties and do 1031 exchanges. For example, you could rent out your beach house for a while, then trade it for another property. If you have renters and act like a business, you’ve probably made the house an investment property, which should be okay for the 1031 exchange rules. Just offering the vacation property for rent without actually having tenants wouldn’t be enough.

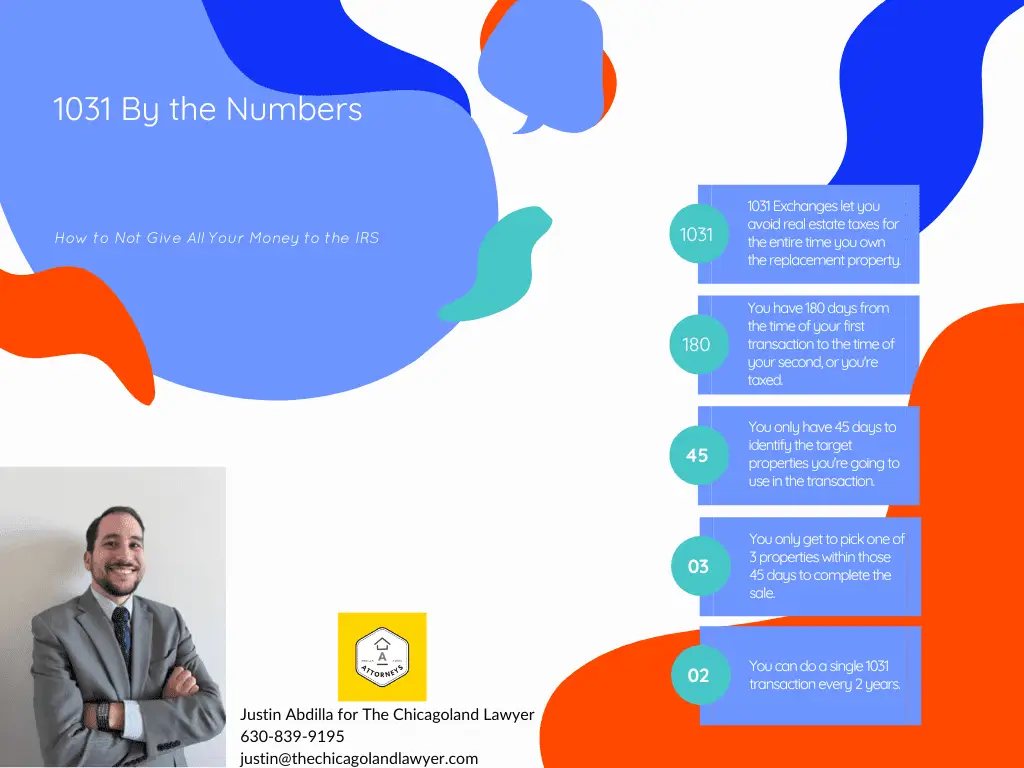

45-Day Rule

The first rule is about choosing the new property. After you sell your property, a special helper called an intermediary gets the money. You can’t touch the money or the 1031 exchange won’t work. Within 45 days of selling your property, you have to tell the intermediary in writing which property you want to buy.

The IRS lets you pick three properties as long as you buy one of them. You can even pick more than three if they meet certain price rules.

180-Day Rule

The second time rule is about finishing the trade. You have to buy the new property within 180 days of selling your old property.

These two time periods happen at the same time. You start counting when you sell your property. For example, if you choose a new property exactly 45 days after you sell, you have 135 days left to finish buying it.

Save 25% on Your Tax Bill When You do a 1031 Exchange on Your Investment Property

No Additional Attorneys Fees for Sellers Doing 1031 Exchanges

1031 Boots – The Leftover Money

After the helper called an intermediary gets the new property, you might have money left. They’ll give it to you after 180 days, but you’ll have to pay tax on it. This extra money is called “boot.”

People sometimes have problems with tax deferred exchanges when they don’t think about loans. You need to think about any loans on both properties. If you don’t get cash back but owe less money, that will also be treated like income and be taxed. For example, if you had a $1 million loan on the old property and a $900,000 loan on the new one, you would have a $100,000 gain, which is also considered boot and will be taxed.

Can I Move Into My New Investment Property after the Exchange?

If you want to live in the property you traded for in a 1031 exchange, you can’t move in right away. In 2008, the IRS made a rule that helps you know if your new property counts as an investment for the tax deferred exchange. To follow this rule, for each of the two 12-month periods after the exchange, you must:

- Rent the property to someone else for a fair price for at least 14 days.

- Use the property yourself for no more than 14 days or 10% of the days you rented it at a fair price.

Also, after trading one vacation or investment property for another, you can’t quickly make the new property your main home and use the $500,000 tax break. Before the law changed in 2004, people could trade one rental property for another, rent the new property for a while, live in it for a few years, and then sell it using the tax break for selling a main home.

Now, if you get a property in a 1031 exchange and later try to sell it as your main home, the tax break won’t apply for five years from when you got the property in the 1031 exchange. This means you’ll have to wait longer to use the main home capital gains tax break.

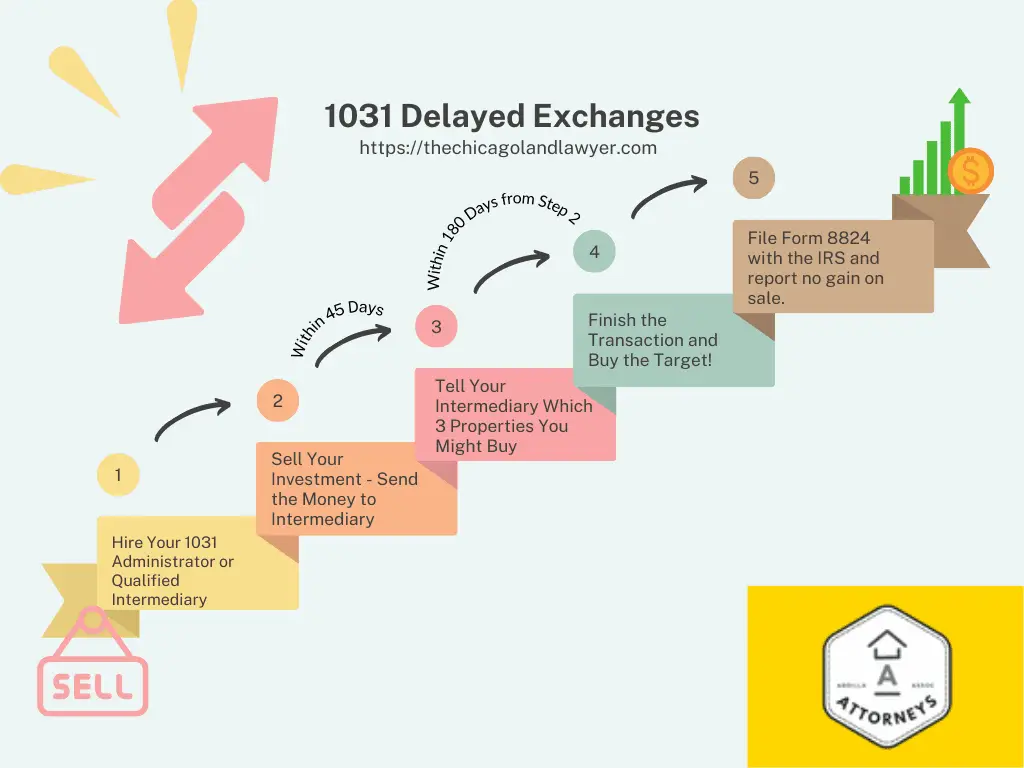

Standard 1031 Exchange (Delayed Exchange)

A Delayed Exchange is the most common type of Tax Deferred Exchange. It happens when a person sells their property (called the “Relinquished Property”) first and then uses the money from that sale to buy a new property (called the “Replacement Property”) later on. The money must go to a Qualified Intermediary, basically just a person who holds the money for you.

Example of a Delayed Exchange 1031 Transaction

Here’s an example of a 1031 exchange: Carlos owns a mixed-use office building on Sheridan worth $4 million, twice what he paid for it. His real estate agent tells him about an amazing townhouse project in Des Plaines for $4.5 million. Using a 1031 exchange, Carlos can sell his mixed-use office building and use the money to buy the bigger property. He won’t need to worry about taxes right away. He can use the extra money to invest in the new property by delaying capital gains and depreciation recapture taxes. Effectively, he gets $500,000 right now, by tax deferment, to perk up his new townhomes!

What Does a Qualified Intermediary Do?

A Qualified Intermediary, also known as an Accommodator or Facilitator, can be a person, a company, or a bank that helps with the tax-deferred exchange process. They have a special job, which is explained in a law called 26 CFR § 1.1031(k)-1(g)(4). 1031 exchange rules say a Qualified Intermediary is someone who:

(A) Is not the person doing the exchange or someone who can’t help (called a disqualified person), and

(B) Makes a written agreement with the person doing the exchange (called the “exchange agreement”) and, as required by the agreement, gets the property being sold, transfers it, gets the new property, and gives the new property to the person doing the exchange.

They’re just a “straw man” person who makes sure you’re not using weird transactions to avoid paying taxes.

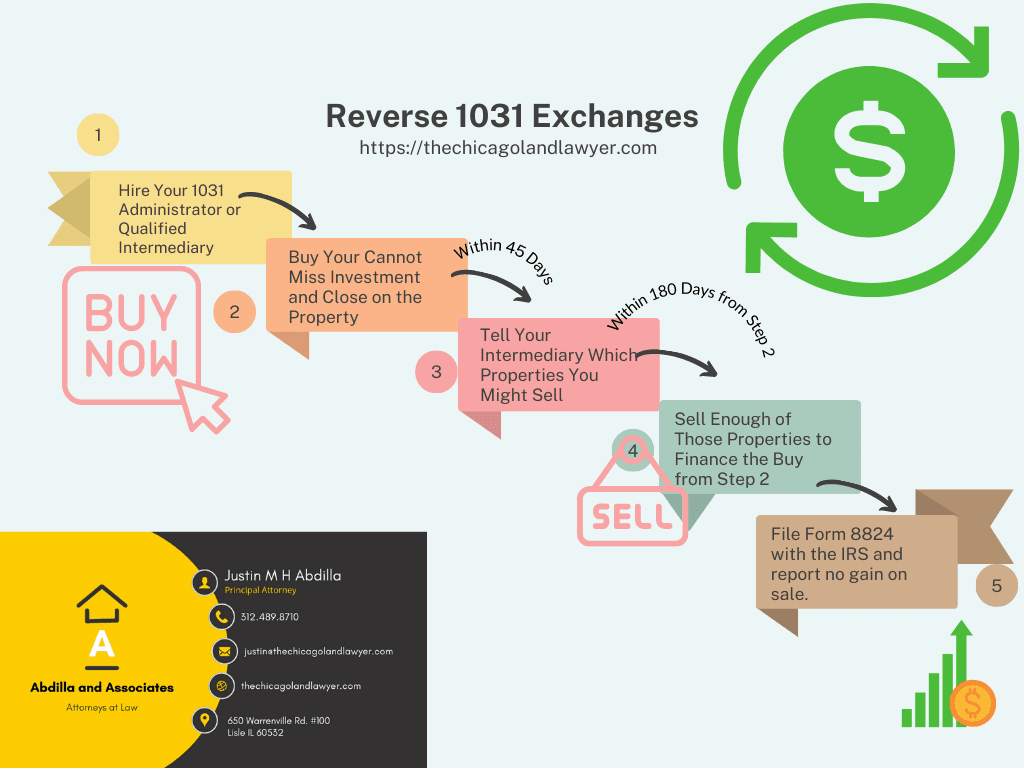

What is a Reverse 1031 Exchange

A “reverse” 1031 exchange is when someone buys the new property first and sells the old one later. Usually, people sell their property and use the money to buy a new one. But sometimes, they find a new property they like before selling the old one. In this case, they can use a reverse 1031 exchange.

The rules for a reverse 1031 exchange come from a section in the tax code. The most important thing is that you can avoid paying taxes if you use the money from the sale of one property to buy another property that is similar. There are also time limits for finding and buying a new property.

The Six Main Steps of a Reverse 1031 Exchange

Reverse 1031 exchanges have six main steps:

- Find someone to hold the title of the new property. This person is called an “Exchange Accommodator Titleholder” (EAT). The EAT is like a trustee for your transaction.

- Buy the new property.

- The EAT takes possession of the title of the new property.

- You choose which property you will sell.

- Work with a qualified intermediary to make sure the exchange follows the rules.

- Sell the old property.

There are time limits for a reverse 1031 exchange. You have 45 days to pick the property to sell after buying the new one, and 180 days to sell the old property after buying the new one. It’s like the Delayed 1031 but Reversed.

There are also rules about the value of the properties, the type of properties, and the number of properties involved in the exchange. Those rules are outside the scope of this article.

Save 25% on Your Tax Bill When You do a 1031 Exchange on Your Investment Property

No Additional Attorneys Fees for Sellers Doing 1031 Exchanges

Reverse 1031 Exchange Example

Suppose Carlos wants to acquire a $500,000 property, and he sells two investment condos at $300,000 and $200,000 within 180 days. Since he is doing a Reverse 1031 Exchange, he needs to pay for the new property upfront, before he gets any of that money. He can use financing, but let’s assume he puts 20% down – or $100,000.

1031 exchange services aren’t free, and let’s assume he’s charged $5,000 for this transaction. Usually, there’s an additional fee for Reverse 1031 Exchanges, something like $500. Illinois also has a title transfer tax of $1/1000 and a county tax of $0.50/1000. He’d be looking at $750.00 in state transfer taxes each way, or $1,500 in tax. It might be even more if the property is in Chicago (Another $3,000+) or Naperville ($1,500+). Carlos might pay something like $8,000 in fees, all-in, to complete this transaction, but he will also save the taxable gains on $500,000 of appreciation ($125,000).

How do I make my Reverse Tax Deferred Exchange Cheaper?

You can use a special purpose entity (SPAC) — typically an LLC set up by your qualified intermediary — to hold your new investment while you finish the transaction. SPACs are legal entities often used in corporate finance and stock market offerings that keep certain properties set aside. They’re a good cheap way to avoid some expenses.

1031 Simultaneous Exchanges (Swaps)

A Simultaneous Exchange is when you sell one property and buy another property on the same day. I often wonder why my wholesale clients don’t use these. There are three ways this can happen:

- Two-Party Trade: The owners of both properties just trade or “swap” the deeds.

- Three-Party Exchange: A third person helps make the trade happen.

- Qualified Intermediary: A special expert helps with the trade and makes sure the rules are followed.

1031 Simultaneous Exchange Example – The “Swap”

Carlos and Johanna both like each other’s property more than their own. They sit down and swap deeds. No money changes hands and the transaction completes in one day.

The “Alderson Exchange”

This will be a three-party exchange. Johanna purchases a replacement property directly from Carlos. Simultaneously, Carlos exchanges it with the Qualified Intermediary for Johanna’s property. This is essentially a transaction where the swap takes place inside an escrow agent’s hands. There are some risks with this type of three-party simultaneous exchange. Carlos will not get a warranty deed, but only a quit claim deed. He might inherit any problems with Johanna’s legal status.

The “Baird Exchange”

In this variation of the above, the QI and Johanna do a swap exchange. Simultaneously, Carlos sells his property to Johanna. For all intents and purposes, this is the same transaction as above, just in a different order.

The “Hodgepot Exchange”

Everyone puts their properties into a company and tells the administrator what they want back for them in exchange. Your administrator immediately says “over my dead body” and refers your transaction to another company. This transaction exists, we learned about it in law school, and nobody would ever do one.

Construction Exchanges – Doing Fix and Flips with 1031s

A Construction Exchange is when you sell a property and then fix up the new one before you take ownership. Effectively, it’s a flip-and-fix. This is how it works:

- Sell the old property and find a new one.

- A Qualified Intermediary (QI) holds the new property.

- You can use the money from the old property to fix up the new one.

- Finally, you can take the new property if:

- It’s pretty much the same as before the repairs.

- The repairs are done within 180 days of selling the old property.

- The new property’s value is the same or more than the old property.

How Does a Construction 1031 Exchange work?

Let’s say Carlos sells his old real estate office building for $1,000,000 and buys a bigger one. But before Carlos Realty can move in, they need to make some changes to the new building. They can use the money from selling the old building to do this.

The old building is sold and the new one is bought, but the person who sold the old building can’t own the new one yet. Someone else, called an “exchange accommodation titleholder” or EAT, has to own it for a while. The money from selling the old building goes into a special account, and the EAT uses that money to pay for the changes to the new building. After the changes are done (within 180 days), the person who sold the old building can own the new one, and the rest of the process continues as usual.

Forward and Reverse 1031 Exchanges for Construction Projects

There are two ways a 1031 construction exchange can happen. In a forward exchange, the old building is sold first, the money is used for the changes, and then the new building is bought. However, in a reverse exchange, the new building is bought first, changes are made, and then the old building is sold. In both cases, there are deadlines to follow. It’s exactly the same structure as these transactions when construction is not used, but the rules are different.

Construction Exchanges & Real Estate Syndications

A construction exchange isn’t always the best choice. Sometimes, people can invest their money in a big property that’s managed by a professional company. This way, they own a small part of the property and get money from it without having to worry about finding a new building quickly or managing it themselves. This can be a good option for some investors.

An example of this would be if Carlos sold Carlos Realty and bought a 1/75th interest on the 12th floor of 10 N. Lasalle St. He’s permitted to sell his building and transfer his ownership into larger commercial projects as a passive investment.

Save 25% on Your Tax Bill When You do a 1031 Exchange on Your Investment Property

No Additional Attorneys Fees for Sellers Doing 1031 Exchanges

1031 Frequently Asked Questions

Q: How do I start a 1031 exchange?

A: Call an Exchange Facilitator and have information about the properties and people involved ready. They’ll ask you questions about the property you’re selling and any replacement property you’re considering. It’s important to ask and answer questions to make sure you understand the process. This is not the place to be cost-conscious. Hire someone really good.

Q: How do I choose a facilitator?

A: Look for an exchange facilitation company online, or ask for recommendations from attorneys, CPAs, escrow companies, or real estate agents. Make sure they don’t act as “agents” of the facilitator too. Ask about their procedures and how they can help if there are problems. Don’t just focus on the price.

Q: Does my property qualify for a 1031 exchange?

A: If you have a property used for business or investment, you can trade it for another property of any type as long as it’s also for business or investment. You can’t trade things like stocks, bonds, or property you’re planning to sell quickly. Also, if you buy and sell properties often, you might be considered a “dealer” and not allowed to do a tax deferred exchange.

Q: What doesn’t qualify for a 1031 exchange?

A: Properties used for personal reasons, like your main house, usually don’t qualify. Also, stocks, bonds, and partnership interests don’t qualify. If you routinely buy property just to sell it quickly or if you’re a developer, you may not be allowed to do a 1031 exchange either.

Q: What are the time requirements in the 1031 exchange rules?

A: After selling your first property, you have 45 days to choose possible replacement properties and 180 days to buy one of them.

Q: What 1031 exchange rules do I need to follow when choosing my replacement properties?

A: By the 45th day, you must clearly describe the possible replacement properties. You can choose up to three properties of any value, or more properties if their total value is less than 200% of the first property’s value. If you choose more properties with a value over 200% of the first property, you must buy 95% of the value of all identified properties.

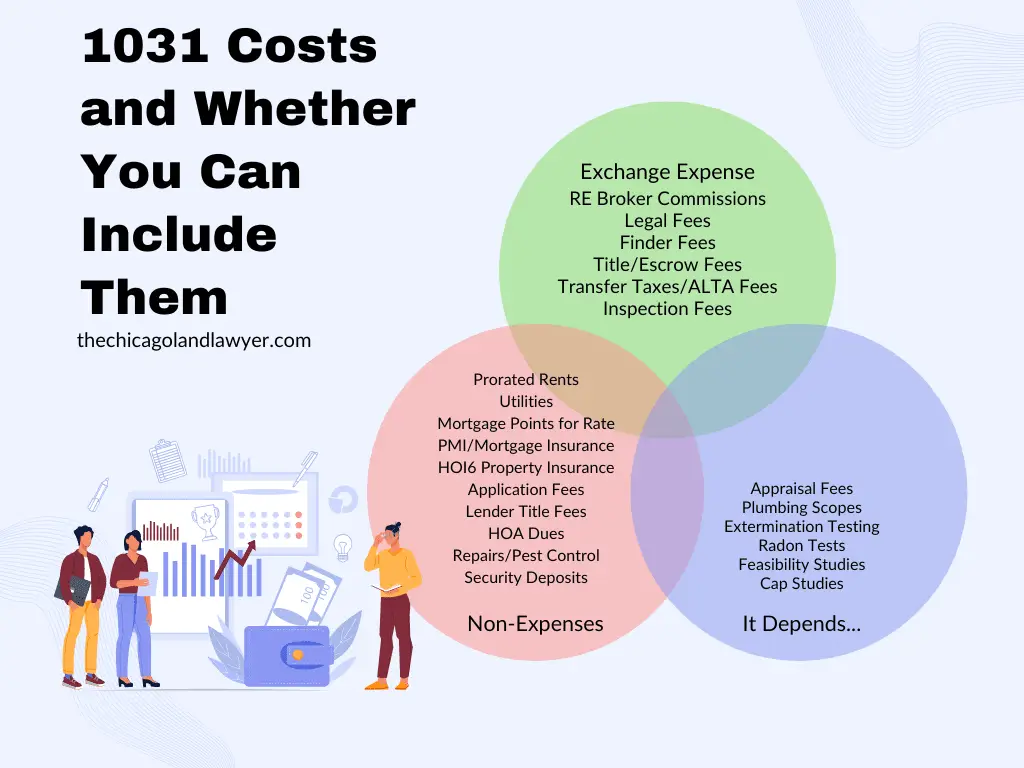

Q: What closing costs can be paid with exchange funds?

A: The IRS says that only “Normal Transactional Costs” can be paid with exchange funds. These costs reduce the amount of taxable money you receive (“boot”) and increase your investment in the new property (“basis”). Some examples of Normal Transactional Costs are broker sales commissions, legal fees, and transfer taxes.

Q: What costs can’t I pay with exchange funds?

A: The IRS considers costs that aren’t Normal Transactional Costs to be “Non-Exchange Expenses.” Under the 1031 exchange rules, they’re taxable boot. Examples of non-exchange expenses include rent proration, utilities, and property liability insurance.

Q: What information do I need on hand for 1031 Exchange rules?

A: You’ll need your name, address, phone number, and the same information for the escrow officer. It’s also helpful to know details about the property you’re giving up and the one you want to acquire, like when you bought it, its value, and how you used it.

Q: Can I exchange one property for multiple properties?

A: Yes, you can exchange one property for more than one property as long as you follow the rules for value, equity, and mortgage. Just make sure you follow the 1031 exchange time and identification rules. This will still be a tax deferred exchange if you do it right.

Q: How long do I have to hold a rental home before I can move into it?

A: The tax code doesn’t specify a time period. Your intent when you acquired the property is more important than how long you’ve held it. Some people believe a one-year hold is best, but this is not a strict rule. For related party exchanges, the minimum hold time is two years. Wait this long before moving in or selling.

Q: Can I make an offer on a property before I sell my current property?

A: Yes, you can make an offer before selling your property, but it’s a good idea to make the purchase contingent on selling your current property. If you must buy a new property before selling the old one, consider a reverse 1031 exchange. Otherwise your tax deferred exchange might not work.

Q: Can I do a 1031 exchange between properties in different states?

A: Yes, exchanging properties across state borders is common. Just make sure to review the tax policies for the states involved.

Q: Can I use exchange funds to pay some costs but not others?

A: Yes, but if you use exchange funds to pay Non-Exchange Expenses, you’ll have to pay taxes on that amount. If you want to do this, you should do it at closing.

Q: Do I need to re-invest the net proceeds or the sales price in an exchange?

A: To fully avoid taxes, you should re-invest in a property equal to or greater than the sales price of the property you’re giving up, including its equity.

Q: Can I get back my initial down payment on the property I’m selling?

A: No, the IRS will tax you on the first money you take out. You can’t get your initial investment back without tax exposure.

Q: Can my business be a tenant in the property I buy?

A: Yes, but your business should pay rent at market value and not receive special treatment compared to other tenants.

Save 25% on Your Tax Bill When You do a 1031 Exchange on Your Investment Property

No Additional Attorneys Fees for Sellers Doing 1031 Exchanges

Q: Can I convert an investment property into my main home and use Section 121 later?

A: Yes, you can change an investment property into your main home. If you sell it after holding it for at least five years, you may be eligible for a tax exemption under Section 121. 1031 Tax Deferred Exchange rules would still apply if you used Section 121.

Q: Can I exchange a foreign property for a domestic one or vice-versa?

A: No, you can’t exchange properties between the United States and foreign countries. You can exchange domestic properties for other domestic properties, and foreign properties for other foreign properties.

Q: Can I use exchange proceeds to improve a property I already own?

A: This is not a conservative option, but some rulings support this strategy. Contact a professional for more information.

Q: Can I exchange one type of business for another, like a hotel for a restaurant?

A: You can exchange the real estate of these types of businesses, but not the intangibles. Goodwill and certain types of personal property cannot be in a tax deferred exchange. Talk to a professional for more details.

Q: Can I do a cash-out refinance before an exchange to pay off loans?

A: Don’t use BRRR or Cash Outs with exchanges. It’s better to refinance either long before the property goes on the market or after the exchange is complete.

Q: Can I go down in value and reduce the amount of debt I have?

A: Yes, you can do an exchange even if you take some money out for other purposes. However, you’ll pay capital gains tax on the difference. In 2023 that tax amount is 25% on the dollar.

Q: What are the guidelines for related party transactions?

A: Related party transactions are allowed, but the IRS restricts them to prevent abuse. These transactions involve family members, corporations with shared ownership, and controlled groups. Rules differ when buying from or selling to a related party, with specific holding requirements for each case.

Q: What are the 1031 exchange rules for cancelation?

A: Canceling an exchange is possible, but the cost and timeframe depend on your facilitator. You can terminate an exchange:

- Before the sale of the relinquished property.

- After the 45th day, if you’ve acquired all the property you’re allowed to.

- After the 180th day.

Q: What’s the difference between Section 1031 and Section 1033?

A: Both sections allow deferring capital gain on the property, but they have different rules and impacts. Section 1031 is for exchanging property used in trade or business, while Section 1033 is for involuntary conversions. The main differences are in the third-party requirements, receipt of funds, time limits, and the Section 1031 Exchange rules.