Two creative financing techniques currently making waves are “Subject To” financing and wrap-around mortgages. With the capricious landscape of today’s real estate market, astute investors are always on the hunt for ingenious methods to maximize their home assets. These techniques have become the most popular ones inside our firm to deliver that promise. While these strategies can unlock a treasure trove of possibilities, they also bring their fair share of hurdles to clear. To successfully navigate these transactions, it’s vital to grasp their pros and cons, design a robust exit plan, and remember that there are no foolproof schemes to success.

Table of Contents

Peeling Back the Layers of “Subject To” Financing

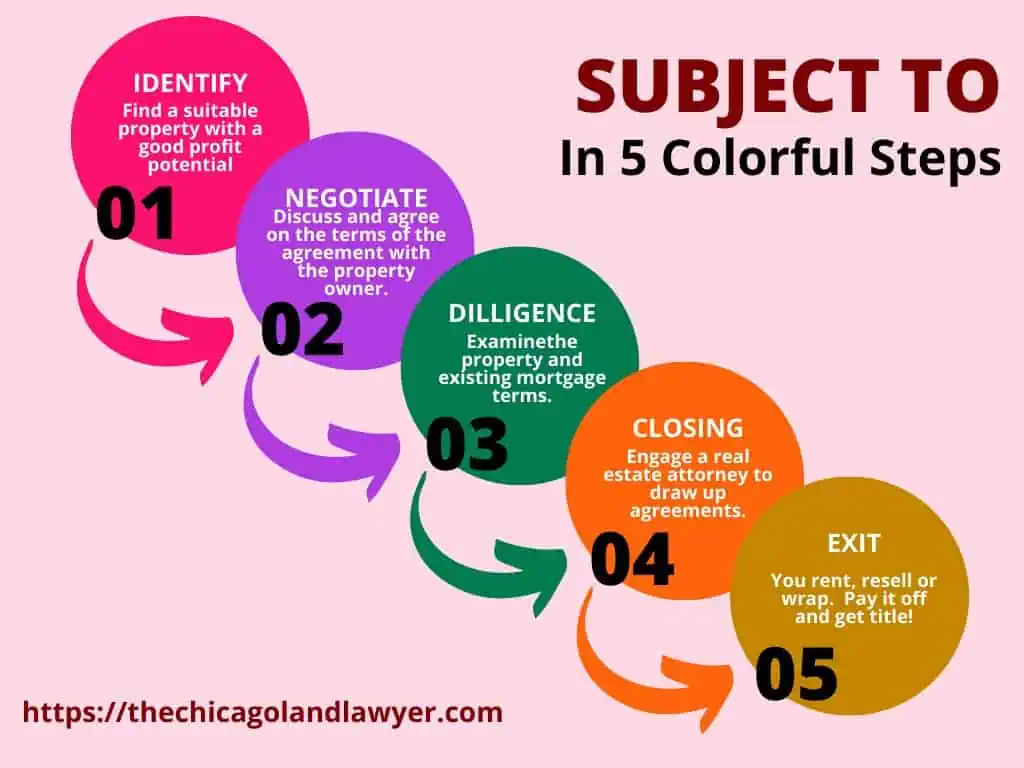

Often referred to as “subject-to”, subject-to-mortgage financing represents a creative twist on traditional real estate financing. It’s a route for investors to snap up properties without the burden of securing a fresh loan. Instead, the purchaser takes the reins of the existing mortgage on the property and maintains the payment schedule. In this deal, the original owner surrenders the property deed, effectively passing on ownership, while the mortgage stays tethered to the original owner’s name.

Subject-to financing has undergone several transformations over the years, with market fluctuations and regulatory adjustments steering its course.

Looking Back:

In the past, when interest rates soared, subject-to financing was a go-to option. A buyer could pocket savings by adopting an existing mortgage with a lower interest rate rather than sourcing a new one. This approach also lent a helping hand to those facing challenges in securing conventional financing due to credit woes or other barriers.

In the heyday of the early 2000s real estate boom, subject-to deals were in vogue as investors aimed to rapidly accumulate properties with minimal financial outlay. Regrettably, this period saw instances of the strategy’s misuse, with some investors assuming mortgages but failing to keep up with payments, creating headaches for the original owners. While not the driving force behind the 2008 financial crisis, the regulatory backlash in 2009 brushed against subject-to financing.

Present-Day Usage of Sub To Financing:

Fast forward to 2023, and subject-to-mortgage financing retains its appeal, albeit primarily among real estate investors and those without the legal footing to access other financing forms. It’s particularly potent when a property owner faces financial strife and must quickly offload a property, or when a buyer encounters roadblocks in obtaining conventional financing.

The recent uptick in subject-to’s usage in seller’s markets, characterized by fierce property competition, is also noteworthy. Investors can wield subject-to as a tool to promise sellers a swifter, streamlined transaction—an attractive proposition in a competitive landscape. The terms of subject-to deals typically tilt in the investor’s favor.

Subject-To Financing’s Recent Metamorphosis:

In the past few years, subject-to financing has seen several evolutions and trends:

Regulatory shifts: Some states have introduced regulations surrounding subject-to deals to safeguard consumers. This change has amplified the need for professional counsel and meticulous deal structuring. Illinois, for instance, revised the Real Estate Brokerage Licensing Act in 2020 to tackle this.

Education and resources: Today, investors have an abundance of resources to guide them through subject-to deals, including online courses, literature, and discussion forums. This has helped to elevate understanding and acceptance of the strategy. You’ll still get pushback, though.

Emergence of wrap-around mortgages: This is a variant of subject-to, where the buyer secures a new loan “wrapped around” the existing mortgage. This arrangement can offer the seller added protection, as they can ensure the original mortgage is paid off if the buyer defaults on the new loan.

Better due diligence: Investors are increasingly recognizing the need for comprehensive due diligence in subject-to deals. This involves verifying the existing mortgage’s status, ensuring no other liens on the property, and understanding potential risks and legal implications.

Land Trusts: To safeguard privacy and potentially sidestep the existing mortgage’s due-on-sale clause. In our playbook, a subject-to deal without a corresponding land trust is a no-go.

Subject-to-mortgage financing is quite the powerhouse. It’s an unorthodox strategy that dances to its own tune. However, the dance floor is laden with legal intricacies and significant risks. Hence, it’s an absolute necessity to have a real estate attorney in your corner before plunging into these types of deals.

We’ve Wrapped Millions of Dollars in Creative and Subject-To Financing

One-of-a-Kind Legal Services for Creative Finance

Why Consider Subject To Finance and Wrap Mortgages

Subject-to transactions—purchasing a property “subject to” its existing mortgage—can be a boon in several ways. Firstly, they’re light on the wallet upfront compared to traditional acquisitions. Instead of securing a new loan, you simply step into the shoes of the seller and continue the mortgage payments. Secondly, a new mortgage application isn’t on the cards, making your credit score a moot point. This can provide an entrance for investors whose credit histories have seen better days.

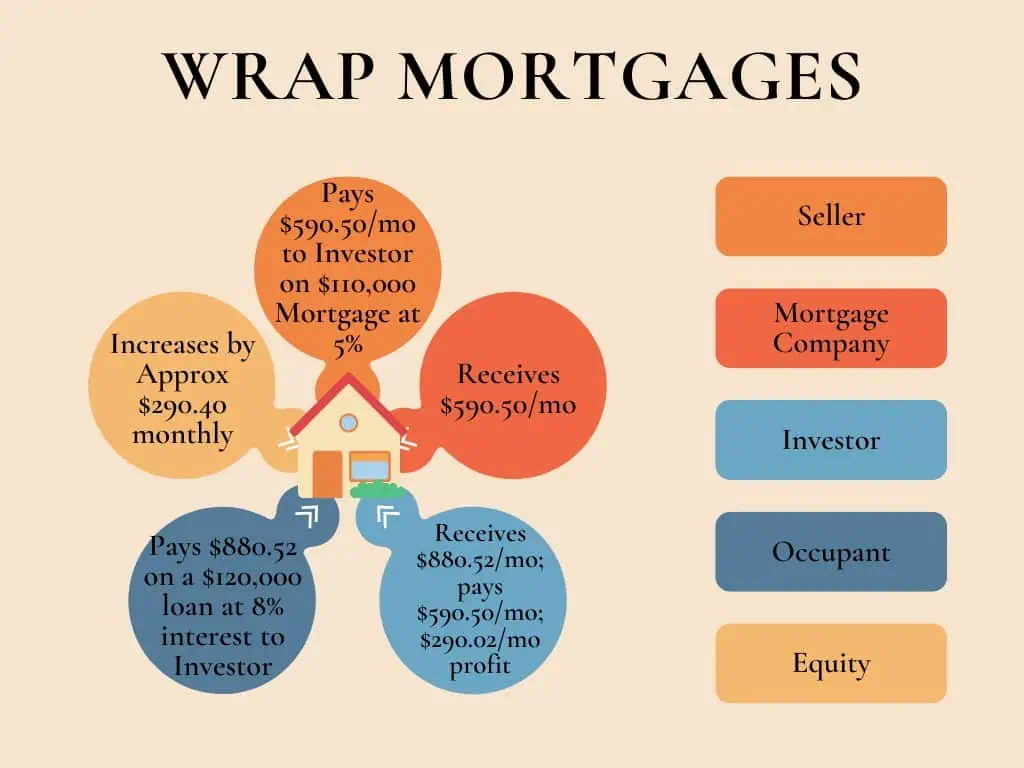

Now, let’s talk about wrap mortgages. These are scenarios where a fresh mortgage “embraces” an existing one. They can be a lucrative proposition too. Such arrangements enable investors to enjoy potentially favorable terms on the existing loan – think lower interest rates or a mortgage that’s already been chipped away at. The potential long-term savings? Significant.

Why You Might Not Consider These Transactions

To begin with, they’re not everyone’s cup of tea. They come armed with a distinctive set of challenges and risks. For instance, the original lender might have a “due-on-sale” clause embedded in their loan agreement. This could mandate full payment of the loan upon deed transfer, leading to an unforeseen financial obligation. Many lenders also have “Assignment of Rents” clauses that can intercept your exit strategy. You could be up the creek without a paddle.

Moreover, a default on the seller’s (the original borrower in a subject-to deal) other debts could be a ticking time bomb. Creditors could slap a lien on the property post-transfer, putting your investment in the crosshairs. Then you’re looking at replevin, ejectment or foreclosure. You’ll lose the whole thing!

The Importance of a Good Exit Strategy

Navigating the labyrinth of subject-to finance and wrap mortgages? Crafting a sturdy exit strategy is paramount. This blueprint should be built on a comprehensive understanding of the local real estate market, probable resale values, and the duration for which you can and wish to hold the property before offloading it.

Consideration of worst-case scenarios is also indispensable. What if you’re unable to keep up with the mortgage payments? Or if the property’s value takes a nosedive? How will you circumvent these risks? The answer lies in meticulous planning, which could spell the difference between a golden goose and a financial fiasco.

Suggested Exit Strategies

- Renting or Leasing: This is a prevalent exit strategy for properties bought subject to. It ushers in a steady stream of monthly cash flow as the investor continues to make the original mortgage payments. If the rent surpasses the monthly mortgage payouts, the investor stands to rake in a profit each month. If not, the investor gains a cushion against substantial losses.

- Lease Options and Seller Financing: Pondering another route? Consider a lease option or seller financing strategy. In a lease-option arrangement, you, the investor, rent the property to a tenant who reserves the right to buy the property later. If you opt for seller financing, you’ll sell the property and step into the financier’s shoes rather than the buyer securing a new loan. In both scenarios, you could possibly sell the property at a premium, with the added bonus of a down payment. While we keep a keen eye on these transactions, they are usually on the right side of the law in Illinois.

- Wrap-Around Mortgages: If you decide to sell the property via seller financing, a wrap-around mortgage could be your key. Picture this – the buyer secures a new loan from you, the investor, which “encircles” the existing mortgage. The buyer then remits payments to you, while you continue fulfilling the original mortgage payments. This can be a lucrative exit strategy, given that the wrap-around mortgage’s interest rate typically outpaces that of the original mortgage. However, be mindful of the increased risk due to the higher leverage if the buyer falls short on payments.

No strategy is devoid of risks and complexities, and these are no exception. The inherent volatility means you must weigh the potential implications for the original mortgage and the unsuspecting seller who brokered it.

Avoid Due on Sale Clauses

For instance, if the mortgage comes equipped with a due-on-sale clause, your strategy could inadvertently activate a clause requiring full mortgage repayment. If the mortgage includes an assignment-of-rents clause, your hands might be tied, rendering these strategies unviable. A savvy tip? Check if the mortgage says “Fannie Mae/Freddie Mac Standard IL Mortgage” at the bottom left. If it does, it’s best to explore other opportunities.

The Rap on Wrap Mortgages

Wrap-around mortgages, colloquially known as “wrap” transactions, are an innovative financing form. Here, a new loan is generated that “envelopes” an existing one. The buyer remits payments to the seller, who then continues to pay off the original mortgage. It’s a classic case of robbing Peter to pay Paul. The interest rate on the wrap mortgage generally supersedes that of the original mortgage, potentially providing the seller with a yield spread margin. These transactions are notably popular in halal finance.

We’ve Wrapped Millions of Dollars in Creative and Subject-To Financing

One-of-a-Kind Legal Services for Creative Finance

Past Uses of Wraps

In the past, wrap transactions were the go-to solution to facilitate real estate sales during high-interest-rate periods or when a buyer couldn’t secure conventional financing. Suppose an existing mortgage had a lower interest rate than the market rate. In that case, a wrap transaction could enable the buyer to enjoy the lower rate. After all, a 3% APR is much more manageable than a 6% monthly interest, almost doubling the affordability. Wraps are thus stellar tools for financing your dream home.

How are they used Now?

Fast forward to the present, wrap transactions, albeit less common than other financing forms, continue to be utilized. They’re a familiar sight in seller’s markets, characterized by fierce property competition and sellers wielding more leverage over terms. Chicago, for example, witnesses a surge in wrap deals, likely influenced by several “mastery” providers. Wraps also come in handy when traditional financing eludes a buyer, or a property owner needs a quick sale, such as in foreclosure situations. Wraps are notably not that rare, the software for mortgage companies even has a “wrapped mortgage” checkbox in it.

Recent Evolutions:

Wrap transactions have adapted over time, reflecting shifts in market conditions and regulatory landscapes. Here’s what’s new:

- Advanced deal structuring: Investors are upping their game in structuring mortgage wrap transactions. Land trusts or LLCs are sometimes woven into the transaction to offer extra protection or privacy. This might render ownership changes virtually invisible to external agencies.

- Use of technology: Technology has made it easier to manage and track payments in a wrap transaction, reducing administrative burdens and making the process more transparent. There is now great software for this administration like RentTrac and Yardi.

- Education and resources: There are now more resources available to help investors understand and navigate wrap transactions. You can readily find these podcasts, or look through forums such as BiggerPockets.

One constant in this ever-evolving landscape is the indispensable need for a proficient attorney, well-versed in both finance origination and real estate law, to navigate a successful wrap transaction.

Navigating the Not-So-Smooth Sailing of Sub To Success (Does Your Current Lawyer Do Tongue Twisters?)

Even though Subject To Finance and Wrap mortgages present intriguing avenues, they’re far from a success ticket. The real estate market is a complex beast, constantly morphing under the influence of countless uncontrollable factors.

At times, the property might not increase in value as predicted, leaving you holding an asset valued less than your initial payment. When depreciation hits, the high leverage can make the impact treacherous. Occasionally, the original mortgage terms may not be as sweet as they first seemed, resulting in unexpected costs. And let’s not forget those instances where sellers weren’t entirely truthful about note balances (we’ve seen our fair share). These are just a handful of reasons why these investment strategies, like all investments, carry risk.

What is a Nominee Agreement in Real Estate?

Think of a nominee agreement like a game of “pretend” in the world of real estate. In this game, one person—the “nominee”—agrees to act as if they own property. Really, they’re just holding it for someone else. That “someone else” is the real owner, but we call them the “beneficial owner” or “beneficiary.”

How Trusts and Nominee Agreements are Like Pretend Fictions

Let’s say you’ve got a comic book that’s really valuable, but you don’t want everyone to know it’s yours (maybe because you don’t want people asking to borrow it all the time!). So, you ask your friend to keep it at their house and say it’s theirs. In this case, your friend is like the nominee. They’re the person whose name is on the “title”—that’s the official recorded document that says who owns the property. But really, the comic book is still yours. You’re the beneficiary.

The nominee agreement is like a set of rules for this game of pretend. It tells the nominee what they can and can’t do with the property. Mostly, they just hold onto it and do what the beneficiary tells them to. They can’t sell it or use it as collateral for a loan without the beneficiary’s permission.

In the world of Chicago real estate, this game of pretend can be a real strategy. It’s all legal, and it can help the beneficiary keep their ownership a bit of a secret. But, remember, just because the nominee is pretending to be the owner, that doesn’t mean the property is protected if the beneficiary gets into financial trouble.

Why Would I use a Nominee Agreement?

Let’s think about this in a way that makes it super simple. Let’s imagine you’re selling a car, but you still owe money on it. The person buying your car agrees to pay you each month, and then you pay your car loan. That’s pretty much what a wrap mortgage is like but with a house instead of a car.

Now, let’s say you’re not too eager for everyone to know that you’re doing this. Maybe the dealership will repossess the car if someone else is driving it (due on sale clause). You don’t want your name on all the paperwork. So, you ask your best friend to help out. You put the car in their name, but they promise it’s still really your car. They’ll do what you say when it comes to the car. That’s what a nominee agreement does. In our example, your friend is the ‘nominee’, and you’re the ‘beneficiary’.

So, here’s how it all fits together. You have a house with a mortgage. You find someone who wants to buy it, but they’re going to pay you each month instead of getting their own loan. Before you close the deal, you transfer the title to your trusty nominee (like your best friend, but usually a trust or an LLC). Now, the buyer pays you every month, and you pay your original mortgage. Your nominee holds onto the title until the buyer has paid in full, then they transfer it to the buyer. This way, your name isn’t in the spotlight, but you still control the property. Seriously, this is pretty complex stuff, and you should always talk to a smart lawyer before doing these kinds of deals.

It’s a bit like if your friend with the comic book got into a fight at school—just because they’re holding onto your comic doesn’t mean it can’t be taken away if they get in trouble. People like us can help you understand all the rules of the game and make sure you’re playing it smart.

The Final Word

Venturing into unconventional real estate strategies like Subject To finance and wrap mortgages can unearth fresh prospects for investors ready to tackle their unique hurdles. By comprehending the pros and cons of these transactions, crafting a solid exit strategy, and accepting that success isn’t a given, you can make educated choices that resonate with your investment goals, setting the stage for prosperity.

We’ve Wrapped Millions of Dollars in Creative and Subject-To Financing